With Abundant Levels of Fear, Uncertainty, and Doubt Surrounding All Scenarios, 'Muddle-Through' Remains Our Base Case (For the Time Being)

The soft landing continues to provide ballast in insanely rough water, but the question remains as to how long a resilient economy can survive the storm

In December, 2023, we published an article here entitled”$7 Mayonnaise Might End Democracy.”

It did - at least in part and insofar as democracy in America has been defined for the past 250 years. And as the inferno we first described in January continues to incinerate everything in its path and the likelihood of the meltdown scenario continues to rise every week, democracy by anyone’s definition may be ending.

Putting aside, in the ultimate form of dissociation, Federal agents invading neighborhoods in Chicago, the military apparently preparing for training exercises in Portland, and the interminable obliteration of the constitution every hour of every day, we’ll focus here on attempting to fill the shutdown-induced, cratered void that was (or wasn’t) last Friday’s jobs report for September that was to have been issued by the BLS - an agency already in tatters thanks to the arsonists in D.C.

In last Wednesday’s post, we forecasted that the economy added a net gain of 80,000 jobs based on the increase in August in the number of U.S. job openings indexed daily from company and employer websites globally. Our forecast was a bit higher than the consensus estimate of a gain of roughly 50,000 jobs and hopefully we’ll get the BLS data in the near future.

But in the interim and given the multitude of significant factors impacting the job market and the economy and how unprecedented and complex the macro backdrop is these days, we thought it would be worth diving a bit more deeply into our data and providing a read on how we’re seeing things these days.

As everyone knows, regarding the macro backdrop, the complexity and opacity of what’s going on centers around if, when, and to what extent policy is going to negatively impact unemployment, inflation, earnings, and GDP.

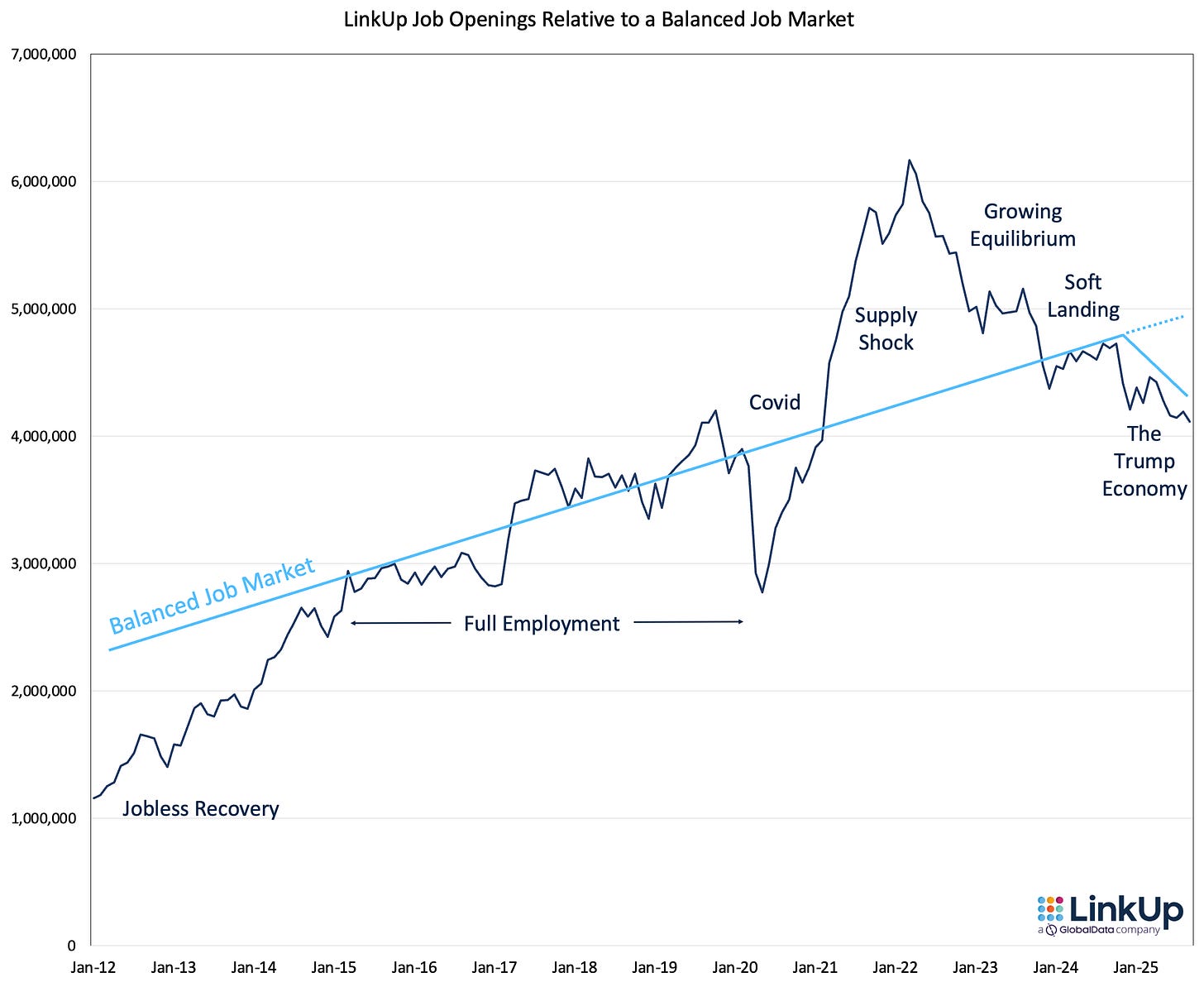

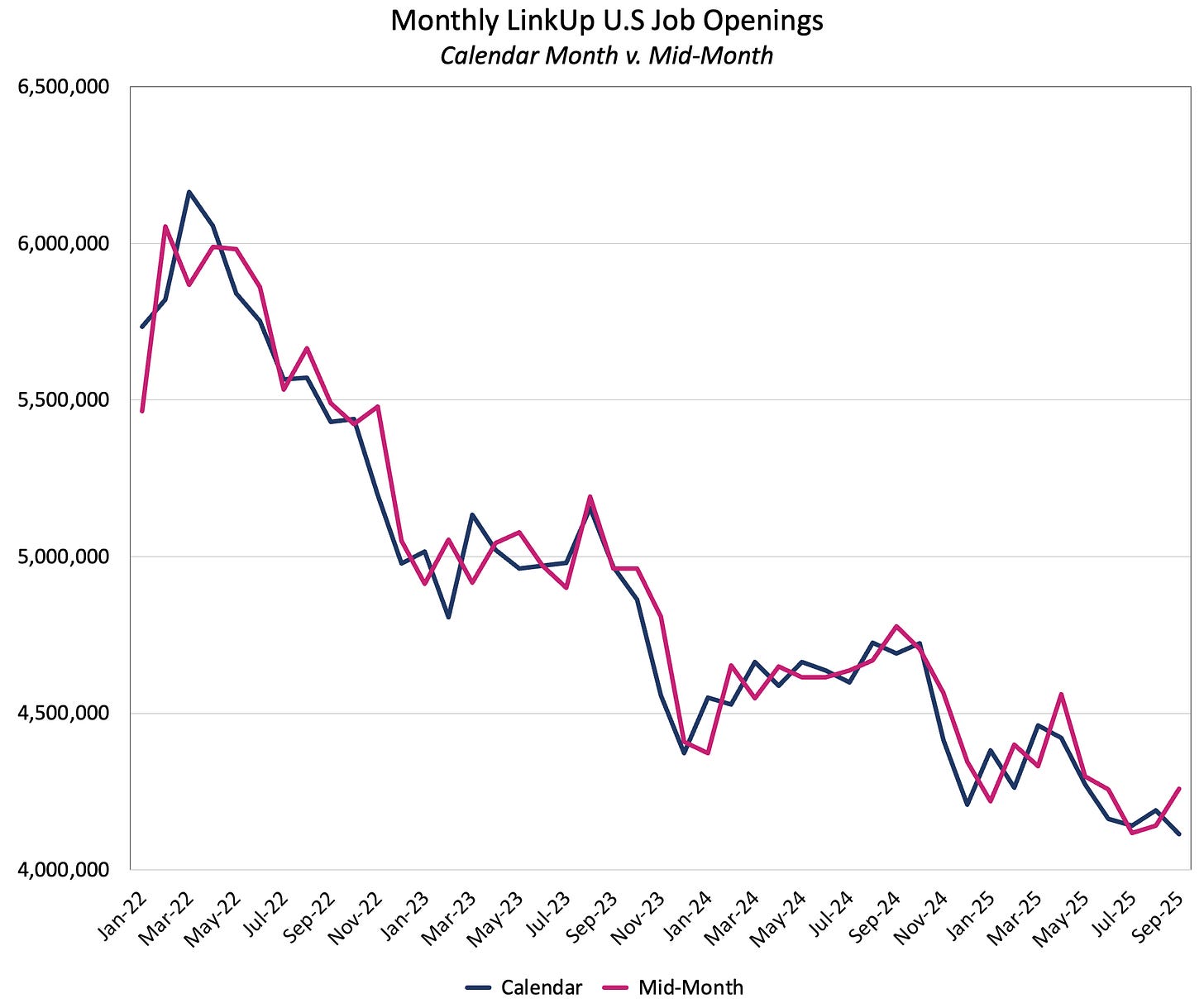

On the job and employment front, the conflagration has clearly annihilated the job market. Labor demand has dropped precipitously (13%) since October…

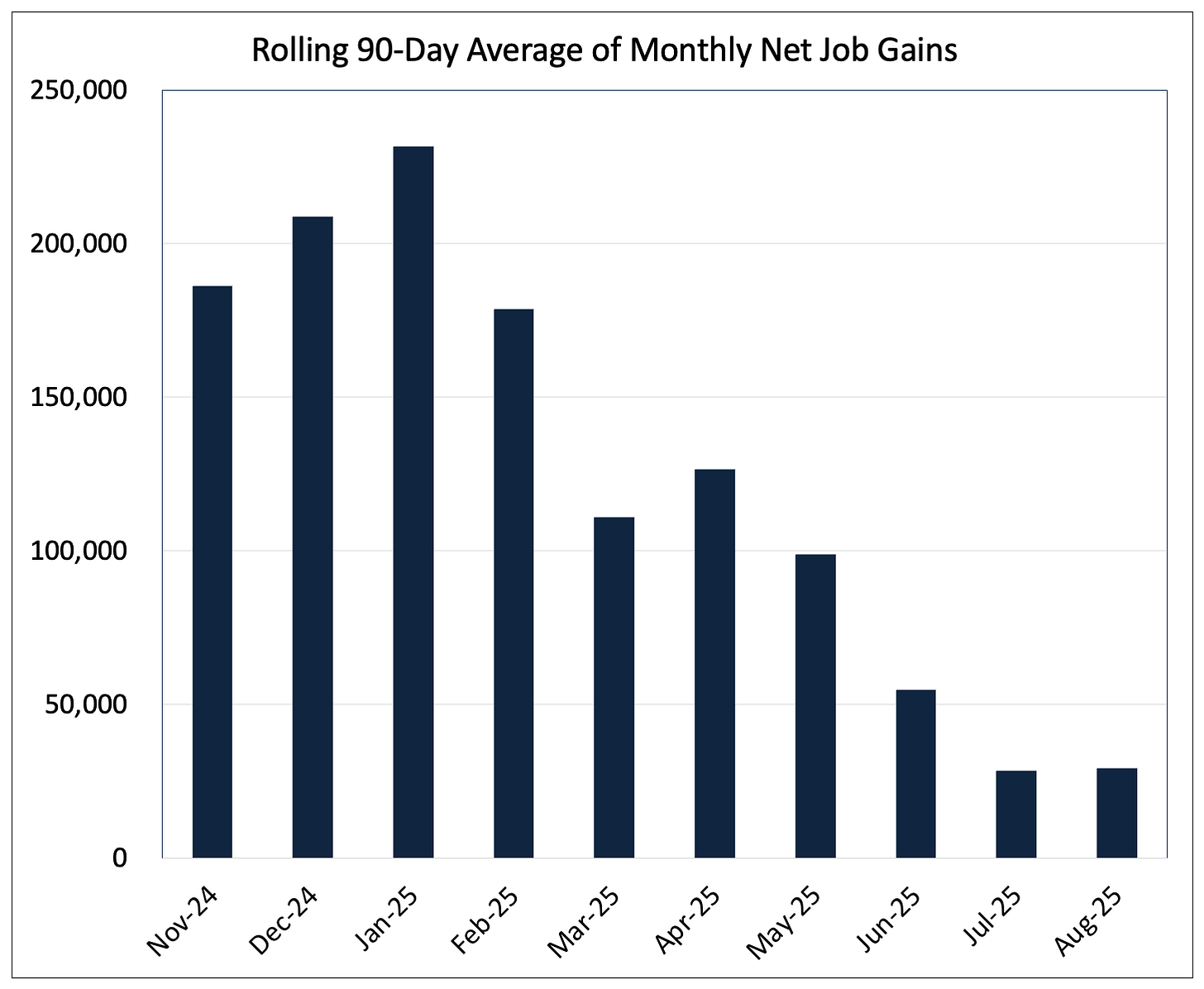

…and job growth, not surprisingly given the decline in vacancies, has plummeted with average monthly net job gains dropping from roughly 120,000 in the first 4 months of the year to roughly 25,000 since May.

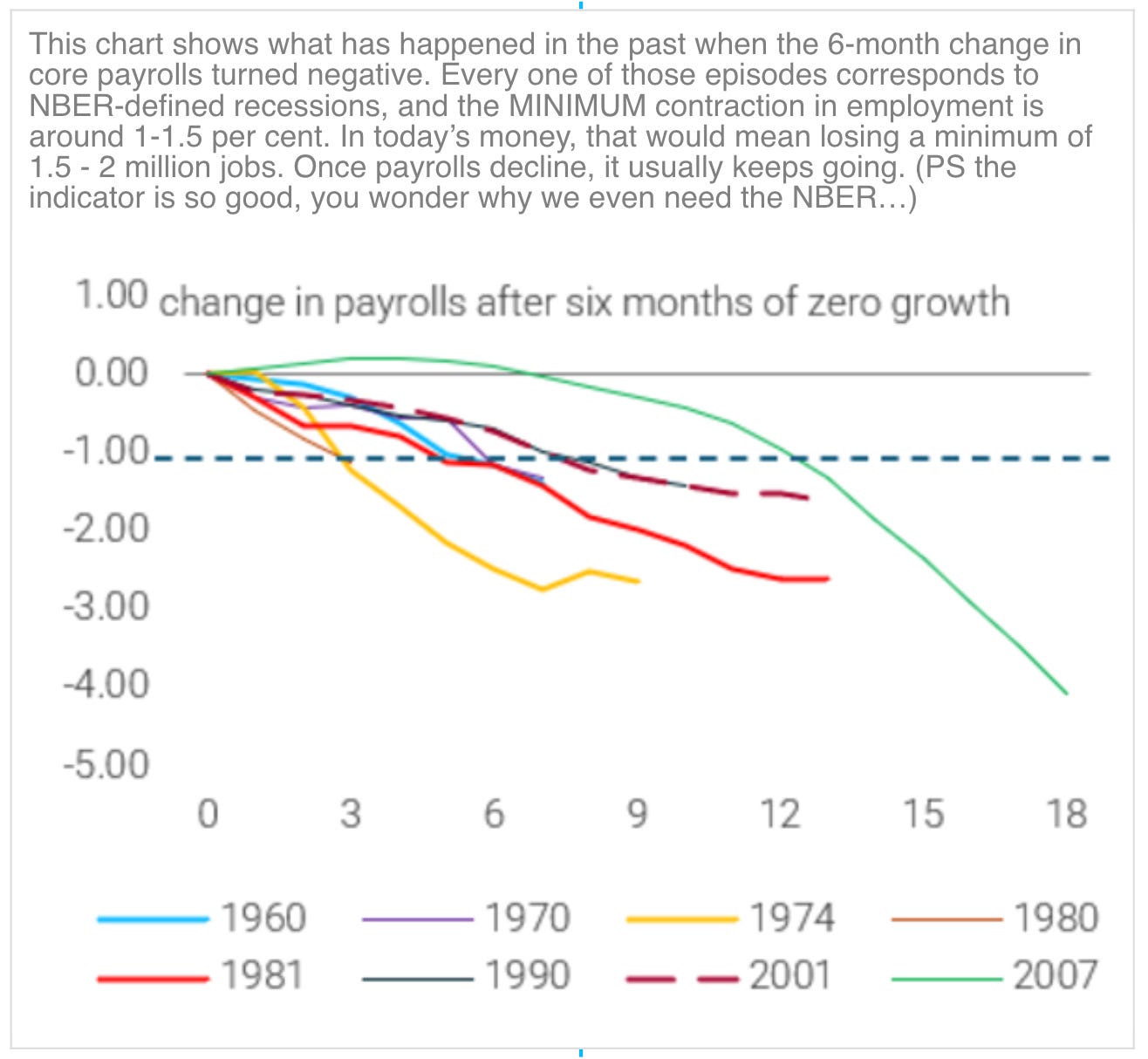

The job market has effectively come to a grinding halt in unprecedented fashion as the chart and commentary posted by Dario Perkins at TS Lombard notes.

Hiring, firing, and quits have all essentially dropped to zero but because of the material drop in the labor force participation rate and the employment population ratio, combined with what’s going in with immigration and deportations and the massive curtailment of labor supply, unemployment has barely budged, rising from 4% in January to 4.3% in August.

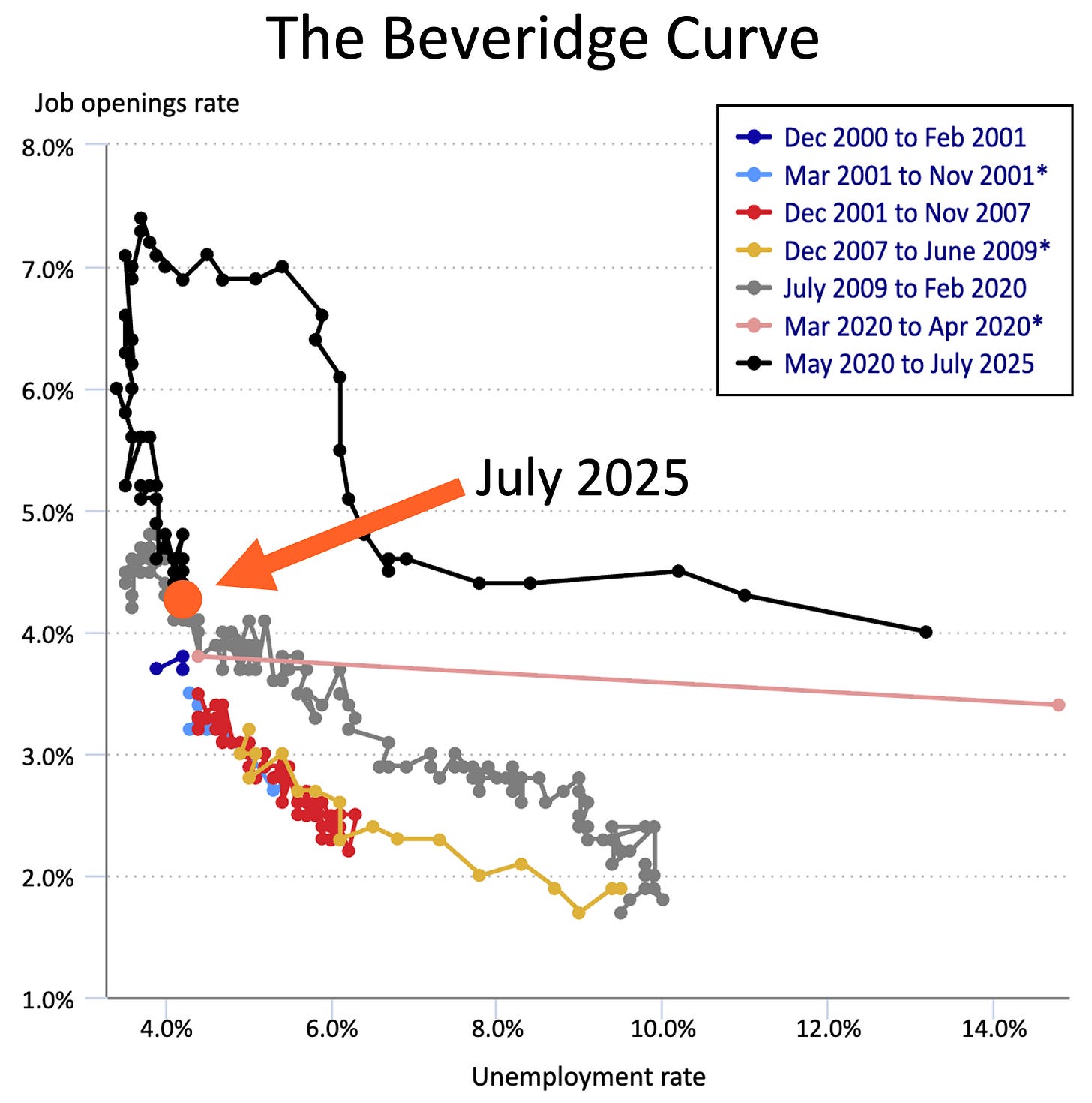

Without question, the alarm bells set off around the job market right now by the Fed, economists, businesses, consumers, and job seekers (especially GenZ where unemployment sits at about 13%) are entirely justified. The job market has weakened substantially and sits at a very precarious position at the moment - right at the elbow of the Beveridge Curve.

Obviously then, the operative question is where things are headed from here and on that score, the Fed, arguably the most important respondent, has given its answer in the form of a 25bp rate cut and a signal of more to come. Lifting another chart from TS Lombard, that decision would seem to be entirely justified.

But as Dario, Freya Beamish (Chief Economist), and the team at TS Lombard have made clear through their research and commentary, it is not necessarily the case that the economy is on an inevitable downward trajectory. In fact, the U.S. economy remains quite strong with a somewhat surprising resilience stemming from the long-term after-effects of the soft landing.

While the significant decline in labor demand and supply and the anemic job growth of late have been dismaying and, in large measure, unnecessarily self-inflicted, they are, to some extent, also reflective of the soft landing, the sustained equilibrium between supply and demand, and the fact that we are still in a full employment job market, even if it’s at a lower level of monthly job growth.

As we’ve noted throughout the covid era and as the chart below clearly highlights, equilibrium was gradually restored in the labor market as employers raised wages to overcome the supply shock. As jobs were filled and the job market came into balance, wage inflation began to moderate and, with assistance from the Fed beginning in 2022, the soft landing was realized.

Inevitably, hiring was going to taper off to its more sustainable, long-term trend and that is precisely what happened up until roughly Q1 of this year at which point both labor demand and supply were reduced materially in equal measure.

But even as we bounce along at a sub-optimal level of job growth, the job market remains in balance, unemployment remains low, and, as our mid-month job openings data for August and September indicates, job openings have started to pick back up even before the Fed cuts had an impact.

To be clear, however, we remain extremely cautious in our outlook as everything everywhere could (and undoubtedly will) change all at once, perpetually. There is plenty to be terrified about these days and a plethora of massive forces are wreaking havoc on the country and the economy and laying waste to stability and predictability.

But given the resilience of the economy and the Fed cut(s) that have started on one hand, and the inferno raging throughout the country on the other hand, our base case at the moment remains a chaotic, highly volatile, and fragile ‘Muddle Through.’

As always, we’ll rely on our highly accurate, real-time dataset of forward-looking job openings indexed straight from employer websites around the world to help navigate through the fog.