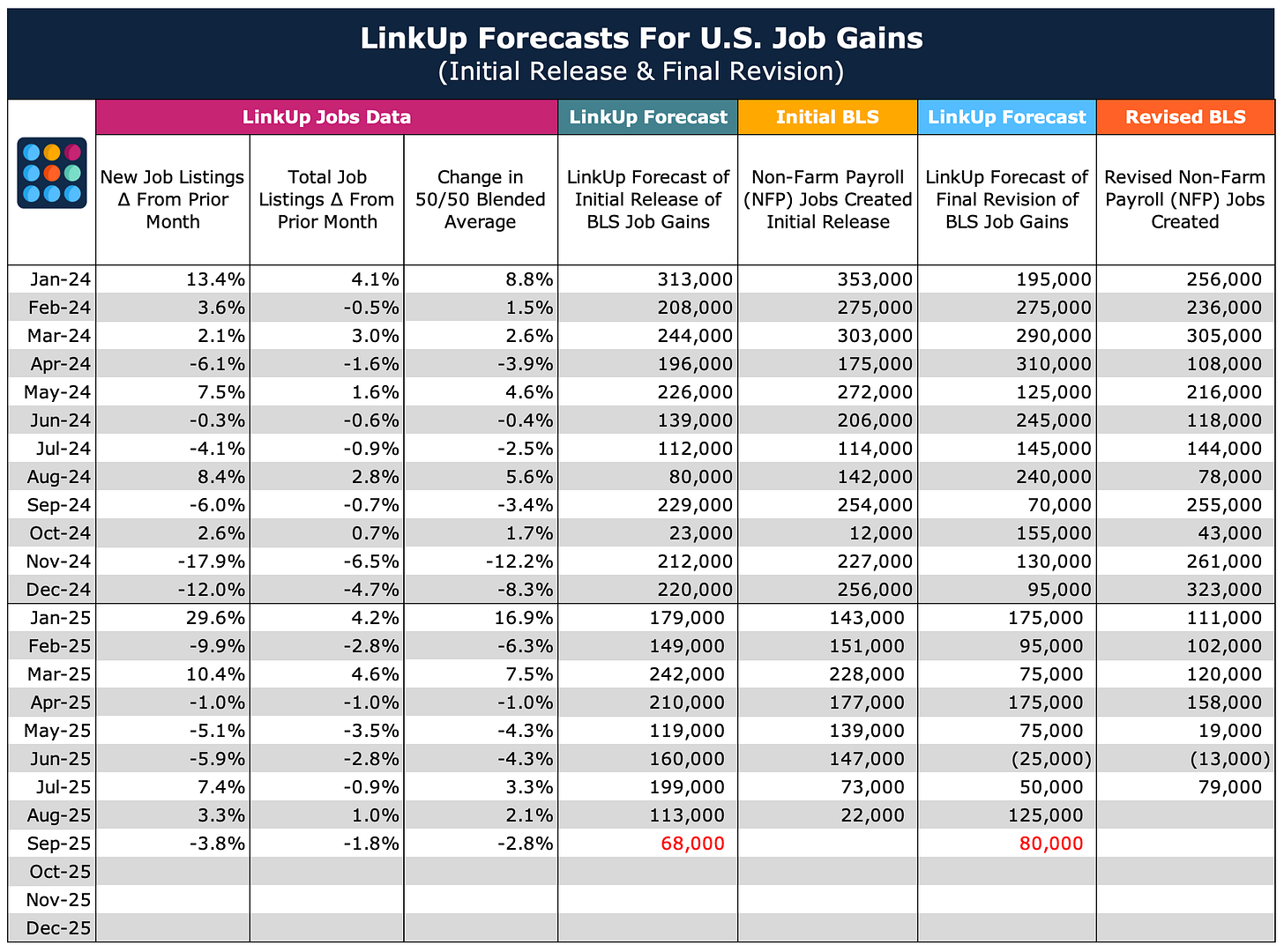

LinkUp Forecasting a Net Gain of 80,000 Jobs in September But Declines from There in October

With the uptick in job vacancies in August and September's mid-month time series, we're forecasting above-consensus gains in September but a likely decline in October.

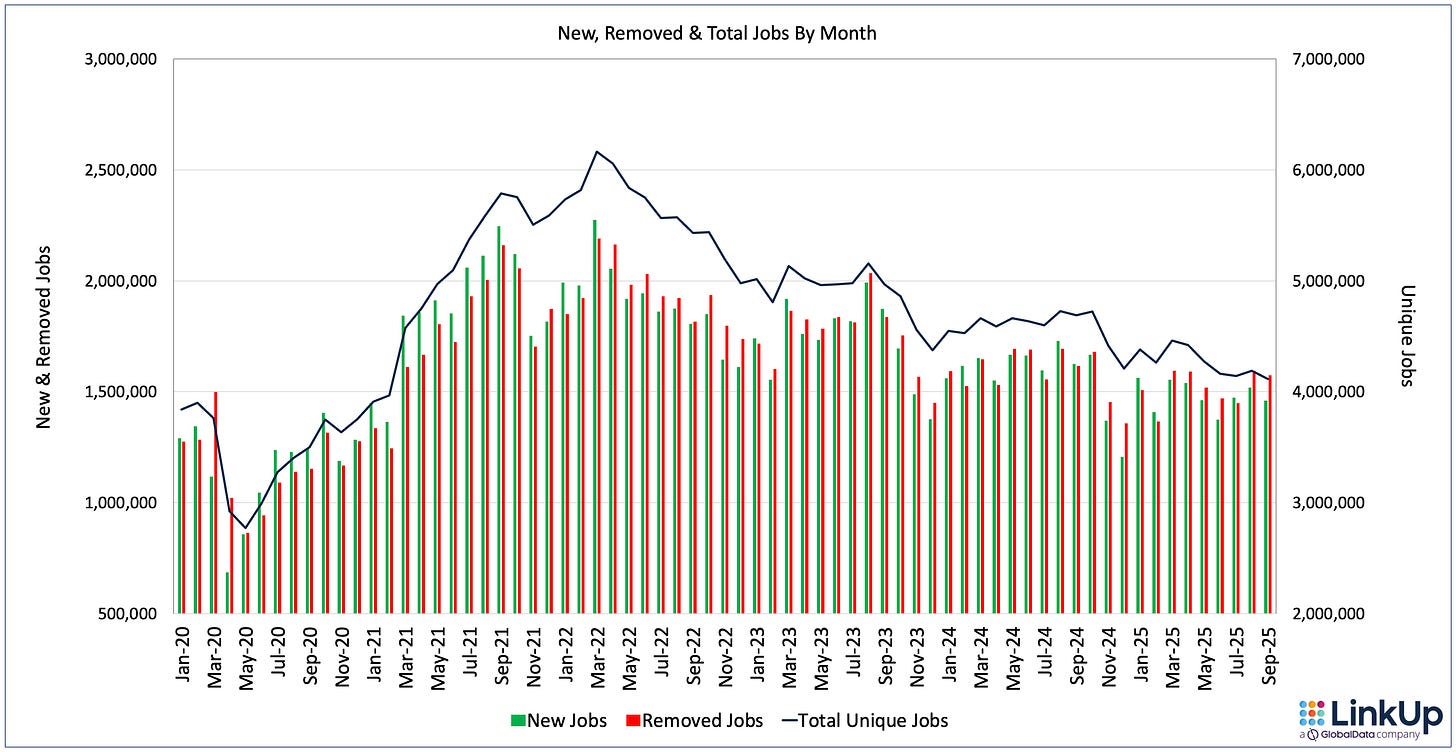

In September, labor demand in the U.S. dropped slightly as LinkUp’s total job openings indexed daily directly from employer websites fell 2% from August and new job openings fell 4%.

In September, all but 4 states showed a decrease in job vacancies.

Similarly, all but 7 states showed a decline in new job vacancies.

Gains and losses in job openings by industry were pretty evenly split across the economy…

…with the largest gains in Professional Services and the largest losses in Retail and Public Administration.

Labor demand rose in Manufacturing but declined in Services.

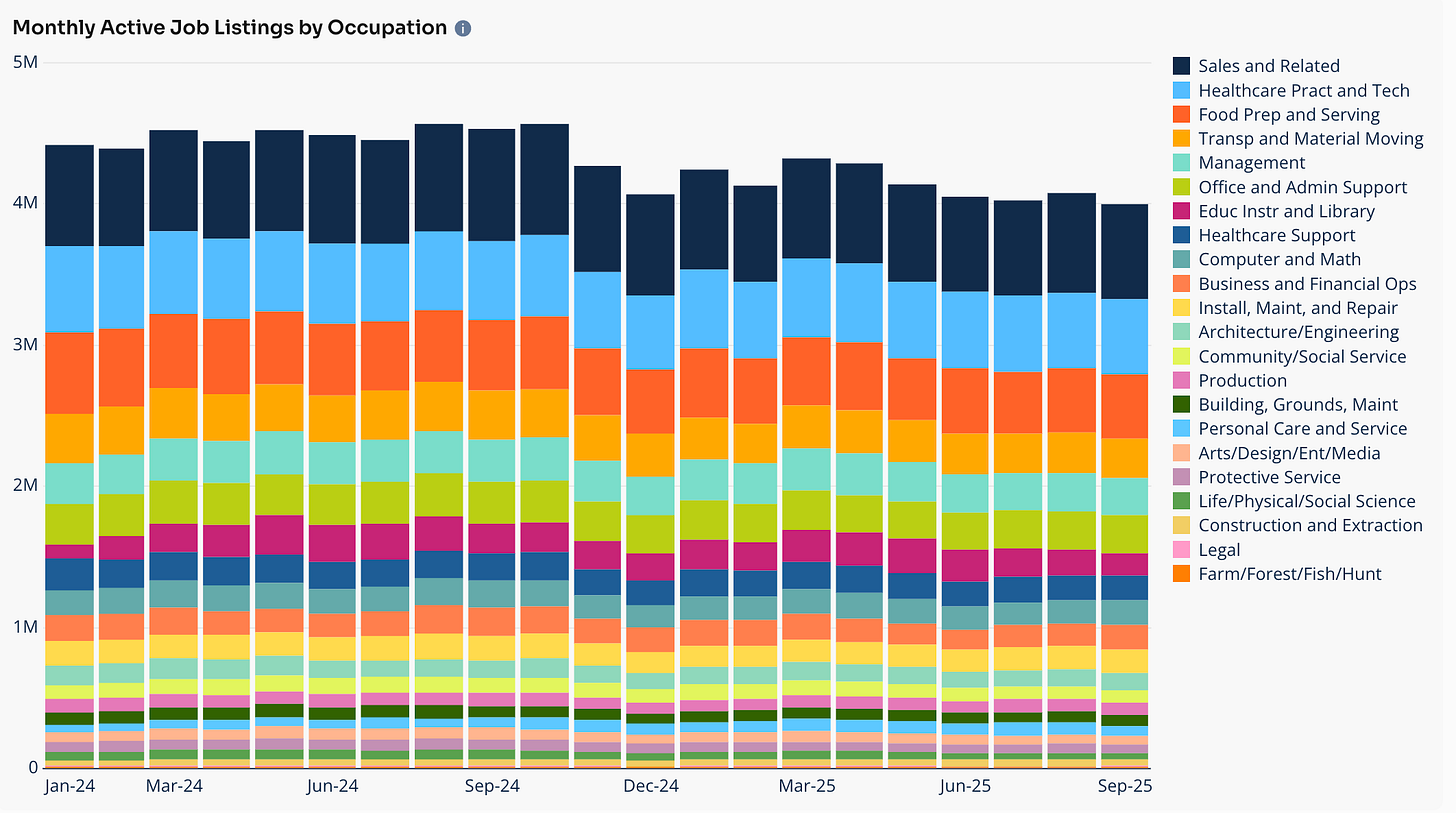

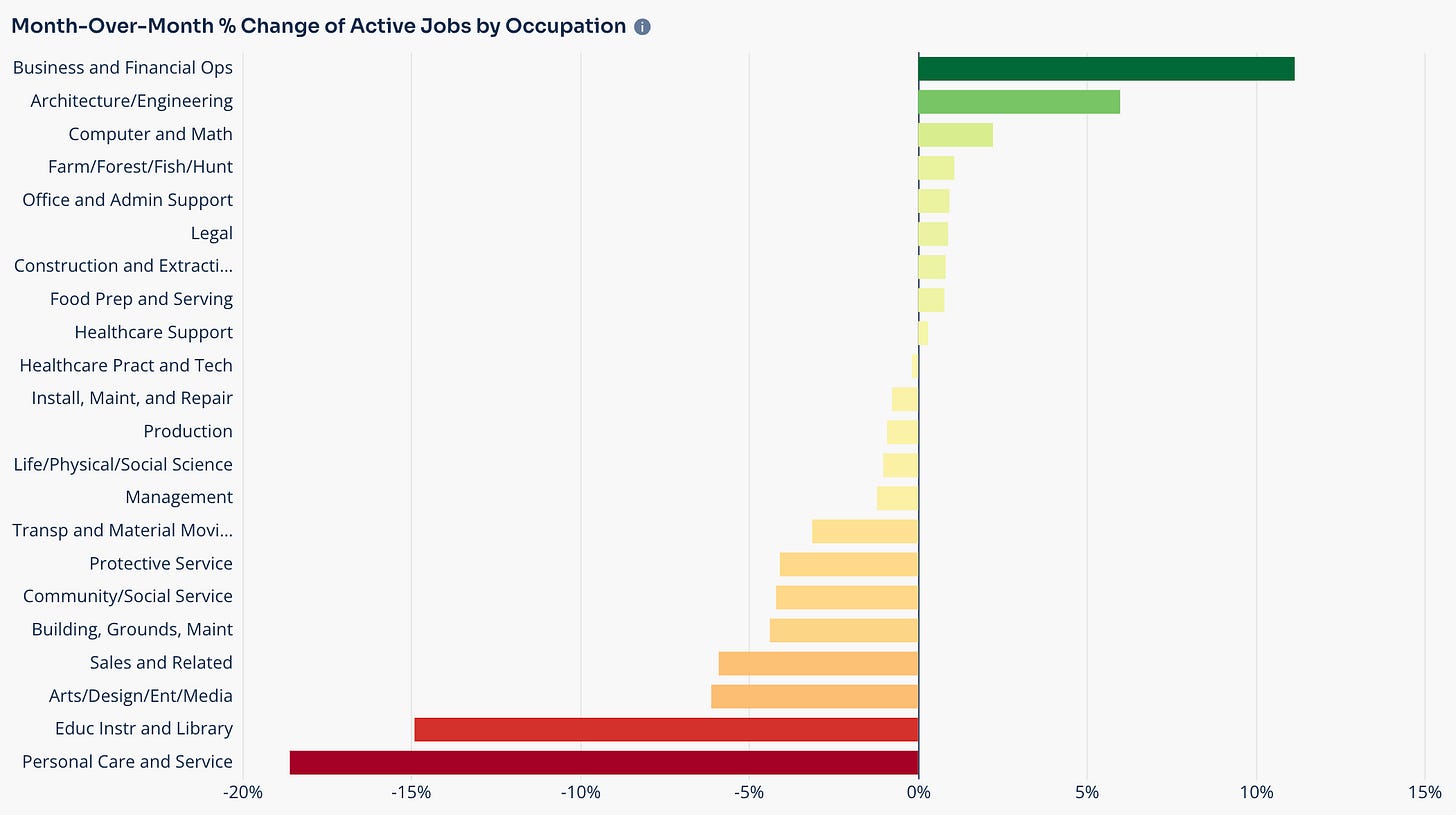

Looking at labor demand by occupation paints a similar story with gains and losses pretty evenly split across the economy…

….with the largest gains in Business & Financial Operations and Architecture/Engineering and the largest declines in Personal Care and Education.

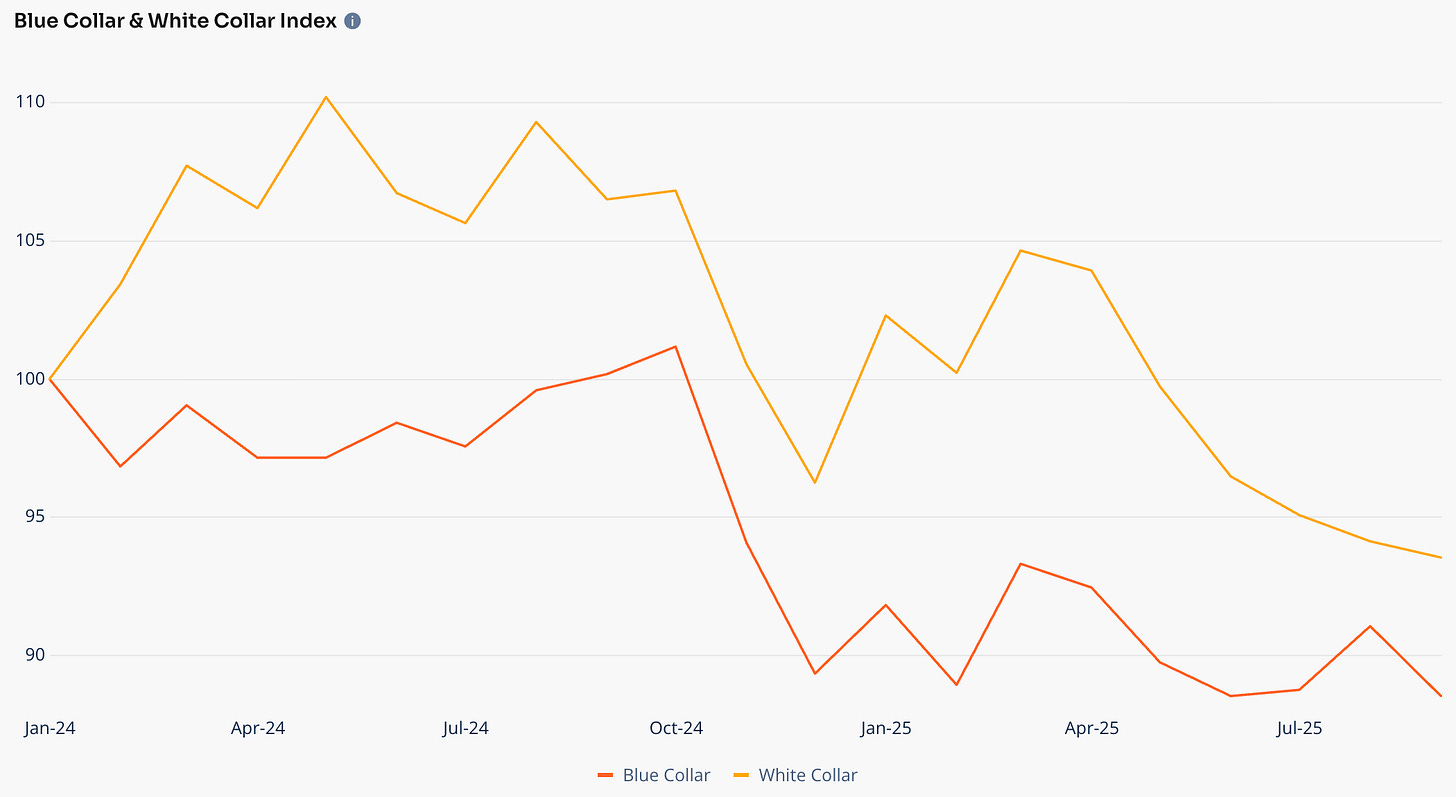

Labor demand for both blue and white collar jobs dropped in September.

Looking at our mid-month time series which maps more closely to the survey period for BLS data, total U.S. job openings rose 3% between the 20th of August to the 19th of September, while new job openings rose 8%.

Based on our data, we are forecasting that the U.S. added a net gain of 80,000 jobs in September. And although we likely won’t get an initial release Friday (and maybe never given the shutdown), we are forecasting that we would have seen an initial release of 68,000 jobs had Friday’s initial release actually been released.

Of course, with the government shuttered at the moment, we’ll have to wait to see what the final numbers will be, but regardless, we’re forecasting that job gains, both the initial and final revised numbers, will be slightly higher than the consensus estimate of 50,000 jobs.