Amid Growing Chaos and Continued Weakness in the Job Market, LinkUp Forecasting Net Gain of Just 95,000 Jobs in February

As flames from the present conflagration start licking the economy, there's little chance this ends well. February's jobs report is likely just the beginning.

With inauguration preparations underway in Washington, the L.A. fires perfectly foreshadowed what was coming for the country and the world and in just the blink of an eye, here we are.

The nihilists elected an arsonist who campaigned from the beginning on burning it all down - the government, the institutions, the country, its founding principles, the world order, the planet. Everything.

After the acolytes were assembled and confirmed by the pyromaniacs and cowards in the Senate, the match was handed to the richest and sickest of all and the fire was lit. By the first cabinet meeting this past Tuesday as Tech Support updated the court, it was clear the fire was blazing and on Friday, the inferno erupted into a fireball for all the world to see.

The only questions now are how long the conflagration will rage, how intense the hellfire will get, how far it will spread, how much damage it will do, and how many people will die.

And for those who’d accuse me of being hyperbolic, particularly on that last point, start paying attention. The Federal workforce is being decimated. 10,000 grants and contracts for billions in foreign aid, most of which goes to feeding the starving, healing the sick, and preventing the spread of disease, have been cancelled. Assistance for the poor and hungry is being eliminated. Medical research has been obliterated. Science has become heresy. An anti-vaxxer runs all the health agencies. Medicare and Medicaid are under siege. Allies are now enemies. Monsters are now comrades.

And this is month one.

Against this apocalyptic background, it might seem minimalistic or trivial to focus on the economy - just a single potential casualty of the fire, but as we wrote in our predictions for 2025, the economy has little chance of surviving unscathed.

More importantly (and sadly), it’s a torched economy that might, in fact, allow Democrats to regain control of one or both bodies of Congress in the 2026 mid-terms, leading to containment or even an end to the worst of the destruction. It could happen even sooner if the markets and/or approval ratings plummet and the arsonist has second thoughts about what he’s doing.

So just as the post-Covid economy was a dominant factor in the 2024 election, it remains paramount still, potentially determining the future of the country and perhaps even the world. And the flames are rapidly approaching.

Both consumer confidence and consumer spending have dropped sharply, inflation hasn’t budged, the private sector is scared shitless about tariffs and mass deportations, uncertainty is off the charts, hiring has slowed, layoffs and initial claims are rising, and broadening weakness in the job market continues to grow.

As has been the case for at least the past 5 years, if not longer, it’s the job market generally, and labor demand specifically, that holds the key to understanding the economy and forecasting its path. And on that front, looking at LinkUp data, things are not looking good.

In February, LinkUp’s U.S. job openings, sourced daily entirely from company and employer websites around the world, fell 4% while new jobs dropped 10% and removed jobs declined 2%.

Job openings fell in every state including Hawaii and Alaska.

For the month, labor demand fell in both manufacturing and services.

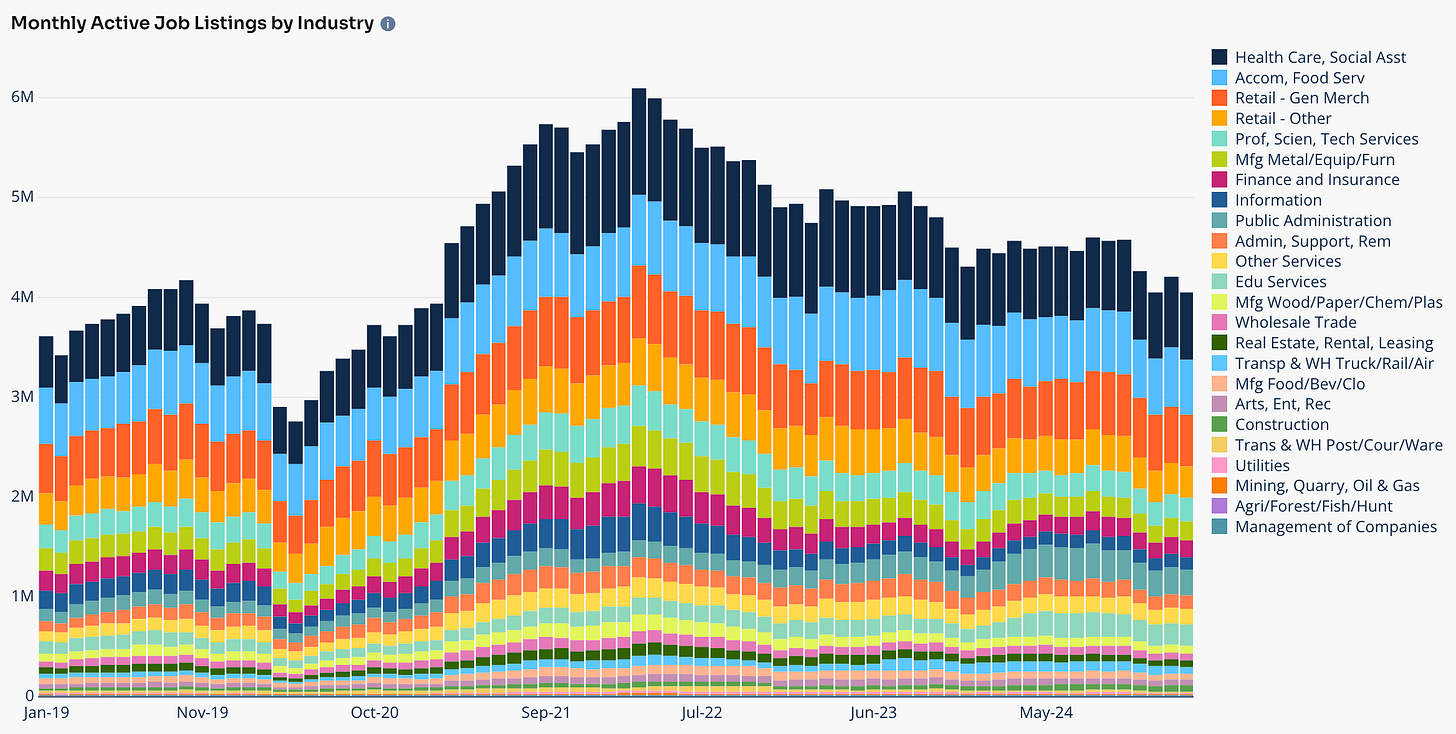

Openings fell in all but 5 industries…

…with the largest declines in Food Manufacturing, Accommodation/Food Services, and Retail - General Merchandise.

Labor demand fell for both white and blue collar jobs...

…with declines in all but 2 occupations (Personal Care and Software Development)…

…and the largest declines in Food Services and Social Services.

In February, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, fell slightly from 47 days to 46 days.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

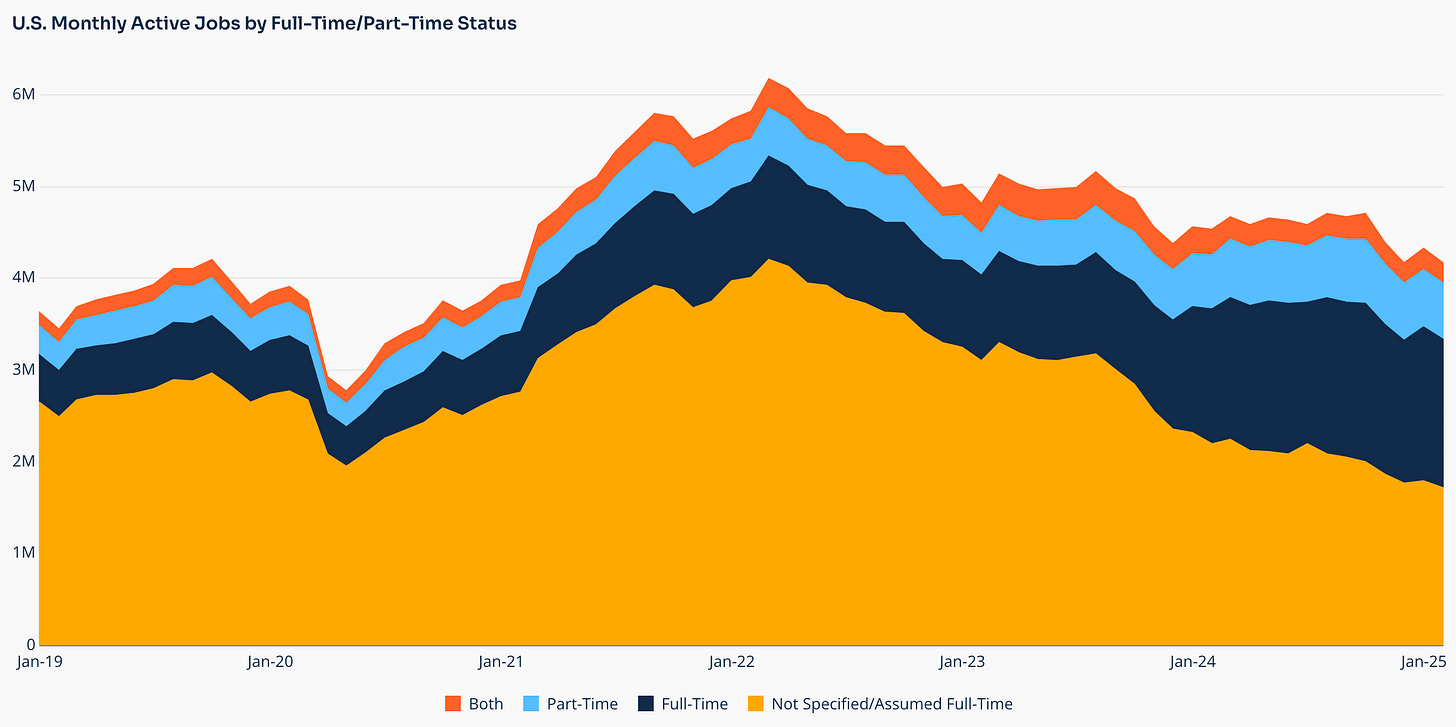

The number of part-time jobs as a percent of all U.S. job openings rose 9 bps in February, climbing from 14.59% to 14.68%.

The number of remote jobs as a percent of all U.S. job openings rose 13 bps in February, climbing from 4.52% to 4.65%.

As noted last month, we’ve made a slight tweak to our NFP model by using a time series that runs from the 20th of the prior month to the 19th of the month being reported so that the time series coincides more directly with the BLS survey week which is always the week that includes the 12th of every month. So for February’s data for our model, the data we used includes new and total unique U.S. job openings in our data from the 20th of January through February 19th.

So based on our Mid-Month data and the 1% drop in the blended average of the change in new and total jobs we saw in January, we are forecasting a net gain of just 95,000 jobs in February, quite a bit below consensus estimates.

For those interested, the graphic at the top was generated (I assume) from an AI prompt from Chad Sowash and/or Joel Cheesman - the fantastic duo behind the Chad & Cheese podcast (a MUST listen if you have any connection whatsoever to HR, HCM, talent acquisition, or the job market) for their last episode during which they touched on my predictions for 2025.