As Austan Goolsbee Says, "The Through-Line Is the Main Line."

A balanced job market with sustainable full employment continues to be the driving narrative behind the soft landing, the economy, inflation, and rates

September’s blow-out jobs number surprised everyone on Wall Street and while we most definitely whiffed on our NFP forecast of 70,000, our non-consensus commentary on the broader narrative around the strength of the job market has been spot on for the past 30 months.

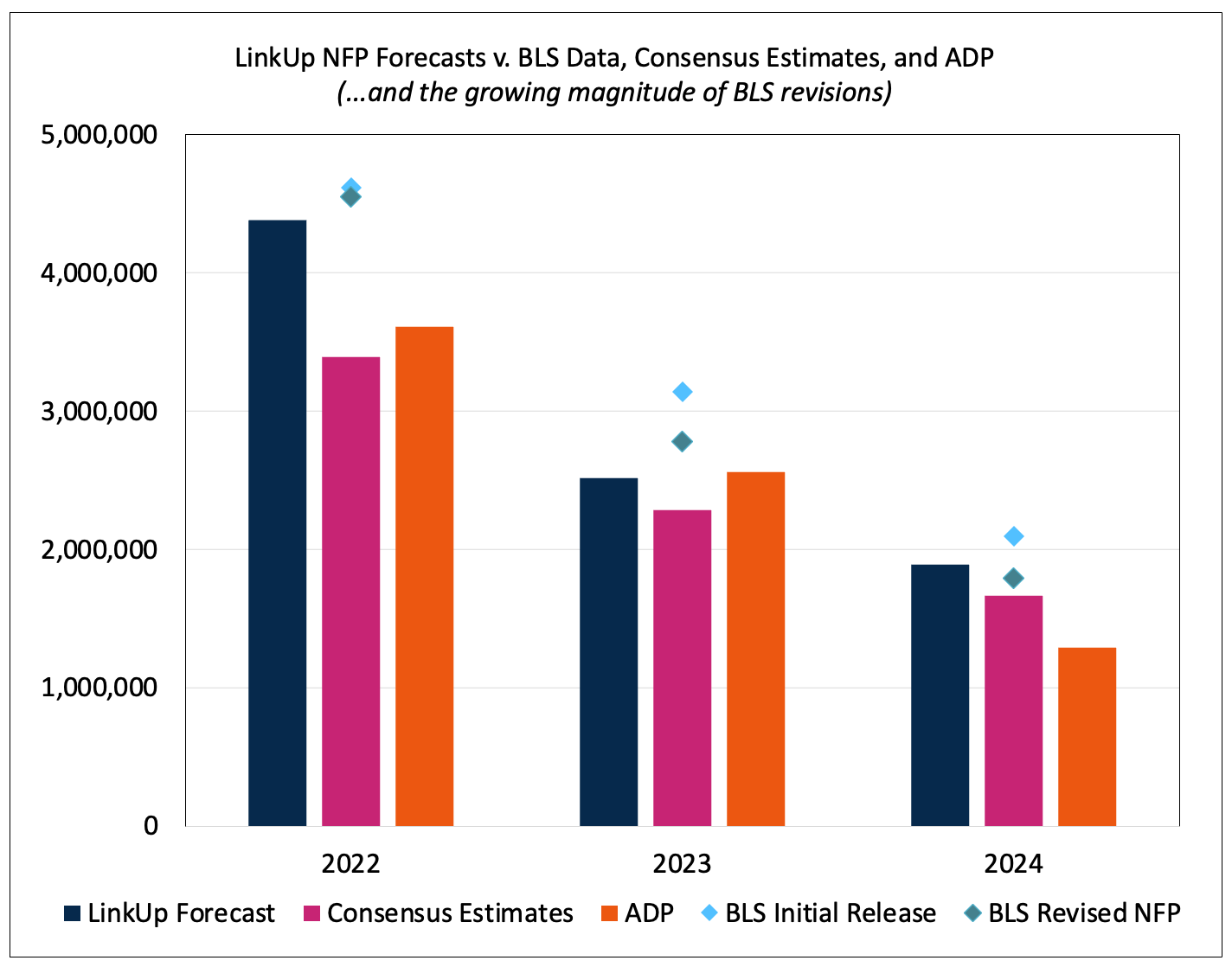

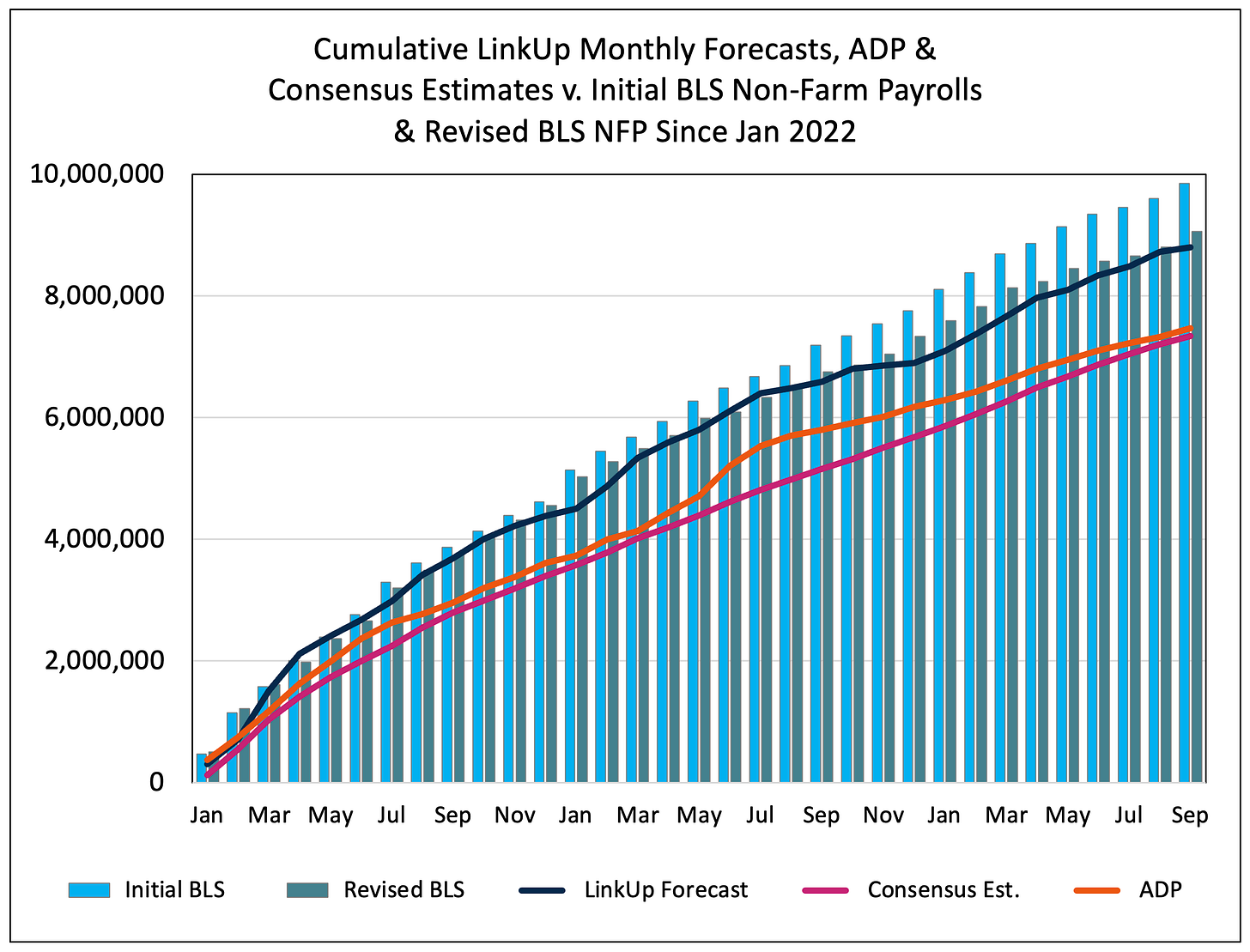

Starting with our job growth forecasts, with a few more revisions for August and September still to come, our cumulative YTD NFP forecast has exceeded revised BLS by 5.5% while YTD consensus come in 7.3% below revised BLS data.

Since January 2022, in this post-covid, tight money era, our forecast tracking error is -2.9% as compared to consensus estimates of -18.9% and ADP of -17.6%.

Since January of 2023, our forecast tracking error is -2.0% as compared to consensus estimates of -12.3% and ADP of -14.5%.

As noted at the outset, we’ve overshot revised BLS numbers by 5.5% while consensus estimates have undershot by 7.3% and ADP has undershot by 28.2%. It’s also worth noting that the cumulative YTD BLS initial release data has overshot the revised job gains by 16.6%.

Arguably more notable than the 13% spread between our YTD track-record relative to consensus estimates is the fact that we’ve consistently delivered non-consensus commentary since at least January 2023 vociferously espousing the soft landing that’s been effectuated by a persistently strong job market that has powered a persistently strong U.S. economy for the past 30 months, much to the envy of the world.

Both our forecasts and the associated commentary are derived from our underlying job market data (millions of job openings sourced daily directly from employer websites globally) which has deviated quite materially from BLS data in two specific instances over those past 20 months

It was the early 2023 (#1) deviation that drove our soft landing call and it was early 2024 (#2) that precipitated our call in January that the Fed would cut rates way later and far slower in 2024 even though markets at the time had priced in 6 or 7 rate cuts for the year.

Throughout the first half of this year, as our data continued pointing to stronger job growth than anyone was anticipating, we continued to deliver Narrative Alpha (to commandeer a phrase from Ben Hunt and Epsilon Theory) centered around forecasting a higher for longer rate regime, even going so far as to declare in April that rates would be Higher Forever.

And so here we are in mid-October. Most (but not all) of the hold-outs have finally disembarked from the plane following the long-past soft landing, the Fed held off until September but made an aggressive first cut, September’s jobs numbers came in way higher than expected, inflation dropped to a 3-year low (2.4%) but its descent is proving to be sticky (and a reascent is on the table), the economy remains rock solid, and the markets are beyond exuberant (albeit with some recent volatility due to a mix of slower rate cut reality sinking in and election jitters).

As Michael Madowitz, principal economist at the Roosevelt Institute, said in a NYT article earlier this month (The Job Market Is Chugging Along, Completing a Solid Economic Picture), “Maybe underestimating the U.S. economy is a bad plan.”

But despite the phenomenal macro backdrop, there is no consensus whatsoever about what path the U.S. economy, inflation, and the Fed might take in the coming months. Of course, it doesn’t help that hurricane season has hit harder than ever, climate chaos is most assuredly upon us, wars are escalating in Europe and the Middle East and potentially even Asia, and civil war could very well erupt in North America in November. Good times.

But back to less fatal things, the question perplexing everyone is what’s next for the economy, inflation, and the Fed. To that end, ignoring biblical factors such as wars, famine, pestilence, apocalyptic weather, and democratically-elected autocratic fascists, the driving force behind the economy will continue to be, as it has been forever and especially in this covid era, the job market.

And as we said in a post in September of 2022, the key to understanding the job market lies in accurate job openings data - everything else is noise. In that post, we quoted Jan Hatzius, Chief Economist at Goldman Sachs, who noted on Bloomberg’s Odd Lots podcast that August:

“The big issue on inflation is labor market imbalance and job vacancies are the key to understanding labor market imbalance. If I had defined Full Employment a year and a half ago, I would have talked about unemployment rate and employment population ratio but open positions would have only had a supporting role. Now, job openings are playing a much more central role because they basically give you the balance between total labor demand and total labor supply.”

As true as that was 2 years ago, it’s proven to be even more profoundly accurate in the subsequent two years. And not only that, but we are now, and have been all year, in a full employment environment being sustained by a perfectly balanced job market with equilibrium between labor demand and labor supply.

And that is the critical narrative. As the 12-year chart of LinkUp’s data along with the Balanced Job Market through-line overlaid on top clearly indicates, the job market couldn’t possibly be more balanced. We first posted this chart in March, and the U.S. labor market has continued to remain in perfect equilibrium ever since. As Austan Goolsbee noted earlier this month, also on the Odd Lots podcast, “The through-line is the main line.”

The perfectly balanced job market in a sustainable, full-employment environment is the through-line that continues to provide huge ballast to the main-line: a strong U.S. economy with steady GDP growth, moderating inflation, slightly elevated wage inflation, and a very measured decline in rates that are likely to remain higher than most anticipate.

We’ll publish our payrolls forecast for October early on Friday morning before the BLS publishes their report (unfortunately it’s a jobs Friday on the 1st of the month), but the report will be little more than noise in any event given the prevalence of hurricanes, strikes, election paralysis, weakening survey response rates, and rising revision volatility, among other things.

Just keep in mind that the through-line is the main-line.