LinkUp Forecasting a Net Gain of Just 70,000 Jobs in September

Despite the underwhelming job growth last month, a solid, very balanced job market continues to power a strong U.S. economy

Between escalating war(s) in the Middle East, Russian advances in Ukraine, Hurricane Helene, extreme heat in the west, and the longshoreman’s strike out east, all against a backdrop of protracted election jitters, it’s been a miserable week on multiple fronts. Unfortunately, we expect tomorrow’s jobs report to add to the pall. Based on our data for September, we are forecasting a net gain of just 70,000 jobs for the month, well below consensus estimates of 140,000.

Given the elevated anxiety and episodically spasmodic volatility these days, we’re likely to see excessive overreaction tomorrow on all sides as alarmists stoke fears of an imminent recession and jubilant market participants pile further into aggressive rate cut positions.

But amid the chaos and din, we’d remind people yet again to focus on the key (and very positive) narrative that continues to underpin the economy - we are in a full-employment environment with a perfectly balanced job market.

It is the extraordinary equilibrium between labor demand and supply, achieved by employers raising wages (thus increasing supply) and the Fed hiking rates (thus dampening demand), along with a few adrenaline shots delivered by via the CHIPS and Inflation Reduction Acts, that allowed the Fed and the White House to orchestrate the soft landing and position the U.S. economy such that it stands today as the envy of the world.

As we wrote just prior to the September Fed cut, the present economy remains in very solid shape, GDP growth is strong, the job market is solid, consumers are spending, businesses are spending, unemployment is low, and inflation has plummeted. September’s rate cut was simply the final announcement for the skeptics and holdouts to collect their belongings and get off the plane after having touched down ever so smoothly. Recent GDP, inflation, and JOLTS data hopefully serve as a swift kick in the ass to those laggards ambling down the gangway.

Regarding August’s JOLTS data released earlier this week by the Bureau of Labor Statistics, we’d note that it rose very much as we expected give the August increase we highlighted a month ago.

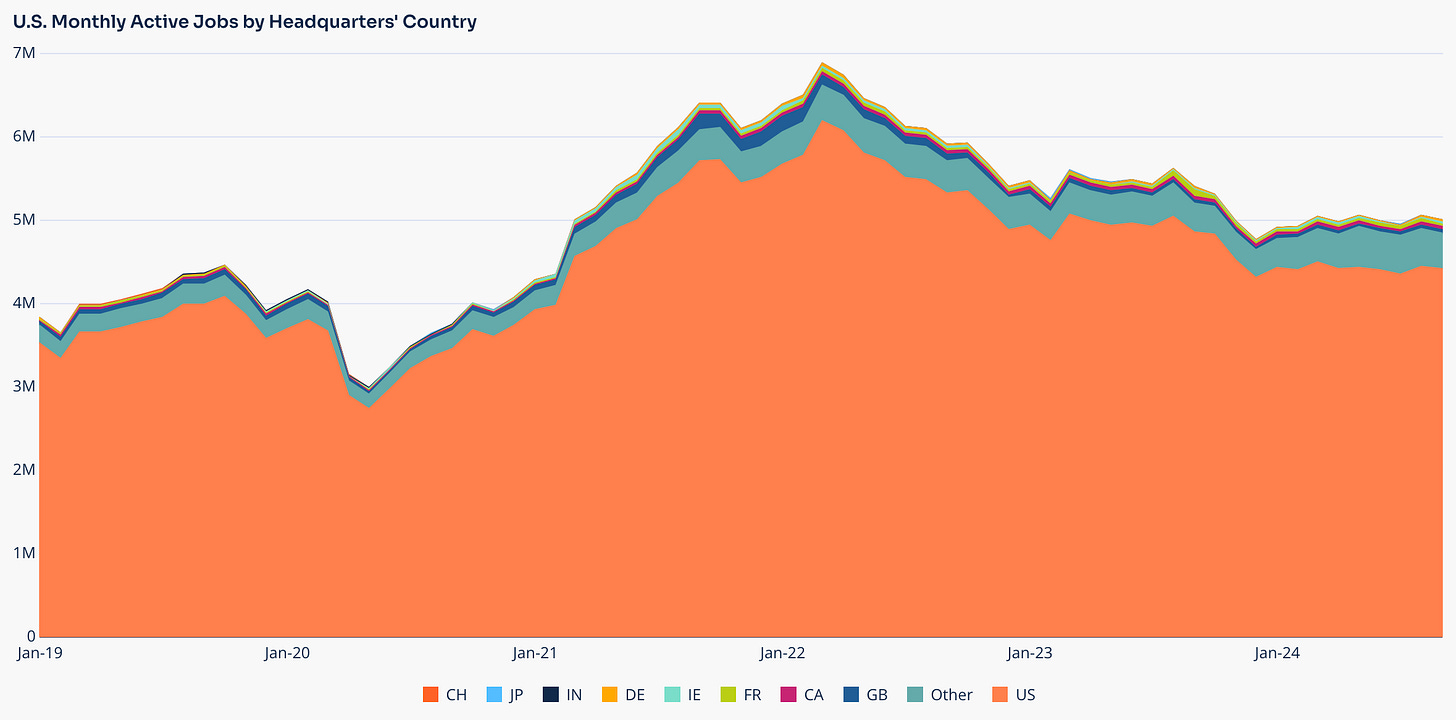

Also of note is the fact that even with the small drop in our September job openings (sourced daily directly from employer websites globally), our data indicates that labor demand in the U.S. is still up 5% YTD. That uptick in labor demand stands simultaneously as both a critical indication of and likely driver behind the remarkable strength of the U.S. economy, a strength that continues to surprise most observers to the upside (especially those still looking at JOLTS data which is down 10% YTD).

So digging into the details for September, total job openings declined 1%, while new jobs fell 5% and removed jobs rose 6%.

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., fell 1% during the month.

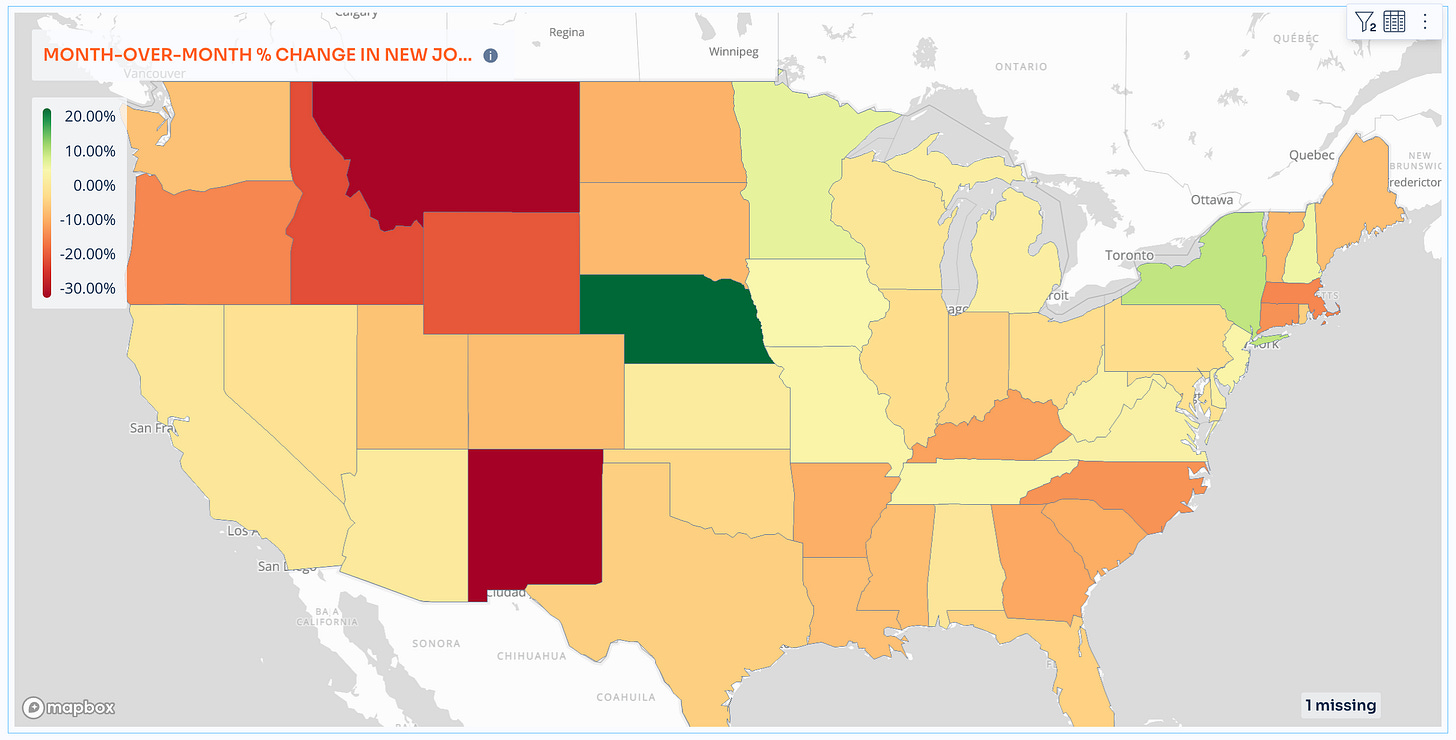

New job openings by state declined in nearly every state with the only increases occurring in Nebraska, New York, Minnesota and New Hampshire.

For the month, labor demand in services rose slightly while demand fell in manufacturing.

Industries showing the largest increases in job openings were Wholesale Trade, Finance, Retail - General Merchandise, and Professional/Scientific/Tech Services.

Labor demand for white collar jobs dropped a bit while demand for blue-collar jobs stayed essentially flat.

The largest gains by occupation were seen in Personal Care and Services, Sales, and Computer and Math.

In September, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, jumped to 46 days - just above the long-term average of 45 days.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration rose in manufacturing and dropped in services.

The rolling 90-day average for Closed Duration fell for both white-collar jobs and blue-collar jobs.

The number of remote job openings in the U.S rose 1% from 252,632 in August to 256,743 in September.

Part-time job openings rose slightly to 681,716 jobs or 13.6% of all job openings. Openings that allowed for either part-time or full-time rose to 248,650 or 5% of all openings.

In the U.S., 561,669 job openings in September (11.3%) were posted by international companies.

So as noted above, based on our data, we are forecasting a net gain of 70,000 jobs in September, well below consensus estimates of 140,000 jobs.

Regardless of the decibel level of the howling tomorrow, keep in mind the larger narrative that a balanced, quite solid job market will continue to power a strong U.S. economy.