LinkUp Forecasting a Net Gain of 240,000 Jobs in August...Likely Along With Yet More Market Histrionics

Solid YTD rise in labor demand and a perfectly balanced job market in a full employment environment power a U.S. economy that continues to surprise to the upside

Perfectly timed for this month’s non-farm payrolls (NFP) forecast, the markets threw another tantrum yesterday reminiscent of what happened precisely a month ago. Similar to early August, yesterday’s meltdown was the result of various (noisy) data points delivering mixed signals that confirmed (or contradicted) wildly divergent views among market participants around how big the expected September Fed cut should (or will) be and, more fundamentally, whether the U.S. is headed toward a recession.

Yesterday’s spasmodic episode was ignited by ISM’s PMI data indicating contraction (which it’s been signaling for 5 months). But like consumer confidence data, survey and sentiment data should always be factored into broader narratives with an appropriate degree of moderation.

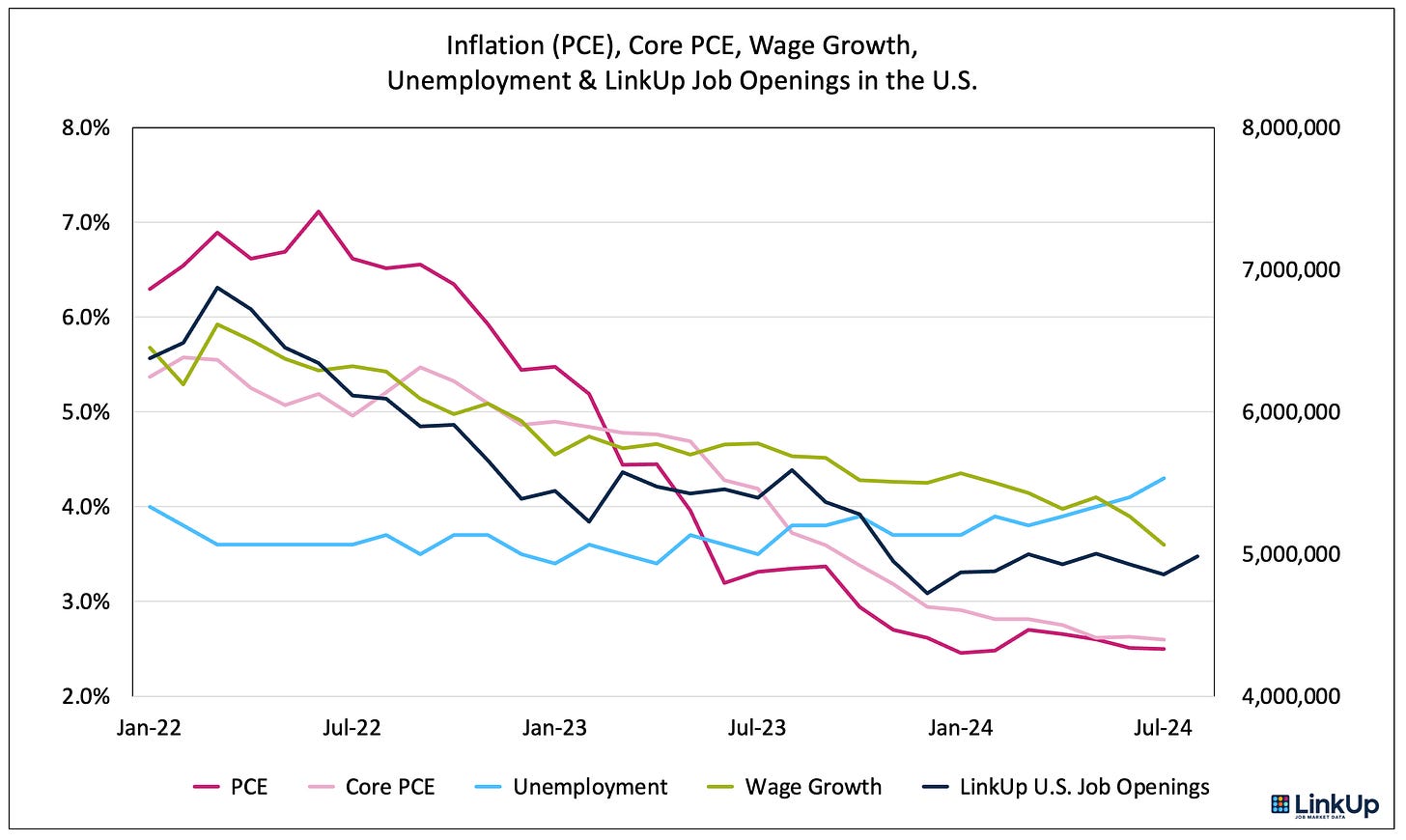

Without question, the broader ‘23-’24 narrative continues to very much be the case that a solid but gradually cooling U.S. economy continues to chug along, powered by steady consumer spending and a resilient, perfectly balanced job market.

And while the downside risk of accelerating deterioration in the job market is rising modestly through this slowing, a recession is nowhere in sight and data points confirming the slowdown are not only to be expected, they should be regarded as a welcomed marker of having arrived at our ultimate destination - the place where rates can calmly start coming down with no signs of distress.

This is precisely the place everyone’s been clamoring for!

Pertaining to yesterday’s histrionics, it’s critical to tune out the noise and stay focused on the key narrative which continues to be that the soft landing has occurred, the economy is in solid shape, the job market is perfectly balanced in a full-employment environment (an ideal condition), and a recession remains a very low-probability scenario.

Today’s JOLTS numbers provides another example of distinguishing between irrelevant and relevant data - in this case lagged, survey-based JOLTS data for July (which we reported a month ago) versus far more accurate, now-casted LinkUp job openings sourced daily directly from company and employer websites globally (which rose 2% in August).

Year-to-date, our data has shown that labor demand in the U.S. has risen 6% while JOLTS data indicates labor demand has fallen 14%. Earlier this year, that divergence, at a moment when markets were pricing in six cuts for the year, resulted in us making a ‘Higher-Forever’ call in April. As Q1 and Q2 data rolled in, the markets were forced to reign in their rate-cut fever dream which led to the protracted, month(s)-long monster tantrum earlier this year.

As an aside, we’ll stick to our higher-forever call with sustained conviction that higher rates throughout the economy will persist - not just the Fed Funds Rate and r* but also inflation, which we expect will stay closer to 3% than 2%.

In any event, we’ll see what happens on Friday when August non-farm payrolls are released, but as Bloomberg noted today in a piece entitled ‘Treasuries Soar as Jobs Fuel Bets on Jumbo Fed Cut,’ the bond market went nuts again today, as “traders built up wagers on a super-sized rate reduction this month.”

The U.S. economy has continued to surprise to the upside all year (and for all of 2023 for that matter) - very much what we’d expect against the defining back-drop of an extraordinarily balanced job market in a Full Employment environment with a step-function increase in wages powering sustained consumer spending in a consumer-led economy.

With the 2% uptick we saw in LinkUp’s job openings in August, we expect a net gain of 240,000 jobs for the month, well above the consensus estimates of 160,000 jobs for August.

And with the even larger 8% jump in new job listings, it’s likely September will surprise to the upside as well.

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., rose 2% during the month.

New job openings by state rose in every single state but one, with the largest increases in North Dakota, Vermont, and Alaska.

For the month, labor demand in services rose a tad more than manufacturing.

Industries showing the largest increases in openings were Professional/Scientific/Tech Services, Admin & Support, and Utilities.

Labor demand for white collar jobs rose faster than blue-collar jobs.

The largest gains by occupation were seen in Business and Financial Operations while the largest declines occurred in Personal Care and Services.

In August, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, rose slightly to 44 days - just below the long-term average of 45 days.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration rose in manufacturing and services.

Likewise, the rolling 90-day average for Closed Duration rose for both white-collar jobs and blue-collar jobs.

So as we noted above, based on our data, we are forecasting a net gain of 240,000 jobs in August, well above consensus estimates of 160,000 jobs.

I can scarcely imagine the mayhem that might ensue Friday if our forecast is in the ballpark. I’d recommend grabbing some popcorn (or some dramamine) and strapping in - it should be an entertaining day.