LinkUp Forecasting Net Gain of 155,000 Jobs In October

Weather will dampen the numbers a bit, but a solid and balanced job market in a full employment environment will continue to power the U.S. economy

Quite fittingly as weather, no doubt, will play a role in October’s jobs report, winter has definitely arrived in the wild north country (mashing together a handful of various Dylan lyrics from the Hibbing native). Estimates for job gains are all over the map due to not just the general confusion around where the U.S. economy is headed and how much longer the job market can sustain the broader economy, but also the extent to which hurricanes will dampen the numbers.

But October’s numbers should be largely be regarded as noise, largely because of hurricanes and strikes, but also because of the fact that not only is it a single data point, but one that will be revised in 30 days and then again in 60 days. What is far more important to keep in mind, as we wrote this past weekend, is that the through-line of an increasingly balanced job market in a sustainable full-employment environment is the main-line that not only drove the soft landing that occurred in 2023, but is continuing to drive persistent outperformance of the U.S. economy is 2024.

This week’s macro data (PCE, GDP, unemployment claims, etc.) were finally, at long last, sufficient to generate a smattering of headlines (at least a year late) announcing the arrival of the soft landing (which, in point of fact, occurred roughly last summer although we started talking about its imminent arrival in early 2023).

The one outlier in the ‘official’ data for the week was the JOLTS report for September which reported that labor demand dropped by 5.3% in September. But September job openings data is old news and the negative signal from JOLTS data, in any event, continues to look more and more questionable given what’s been happening in the job market and the economy all year.

We’d point instead to our data, based on millions and millions of job openings sourced every day directly from employer websites all over the world, as a far more accurate, real-time indicator of what’s actually happening in the U.S. job market.

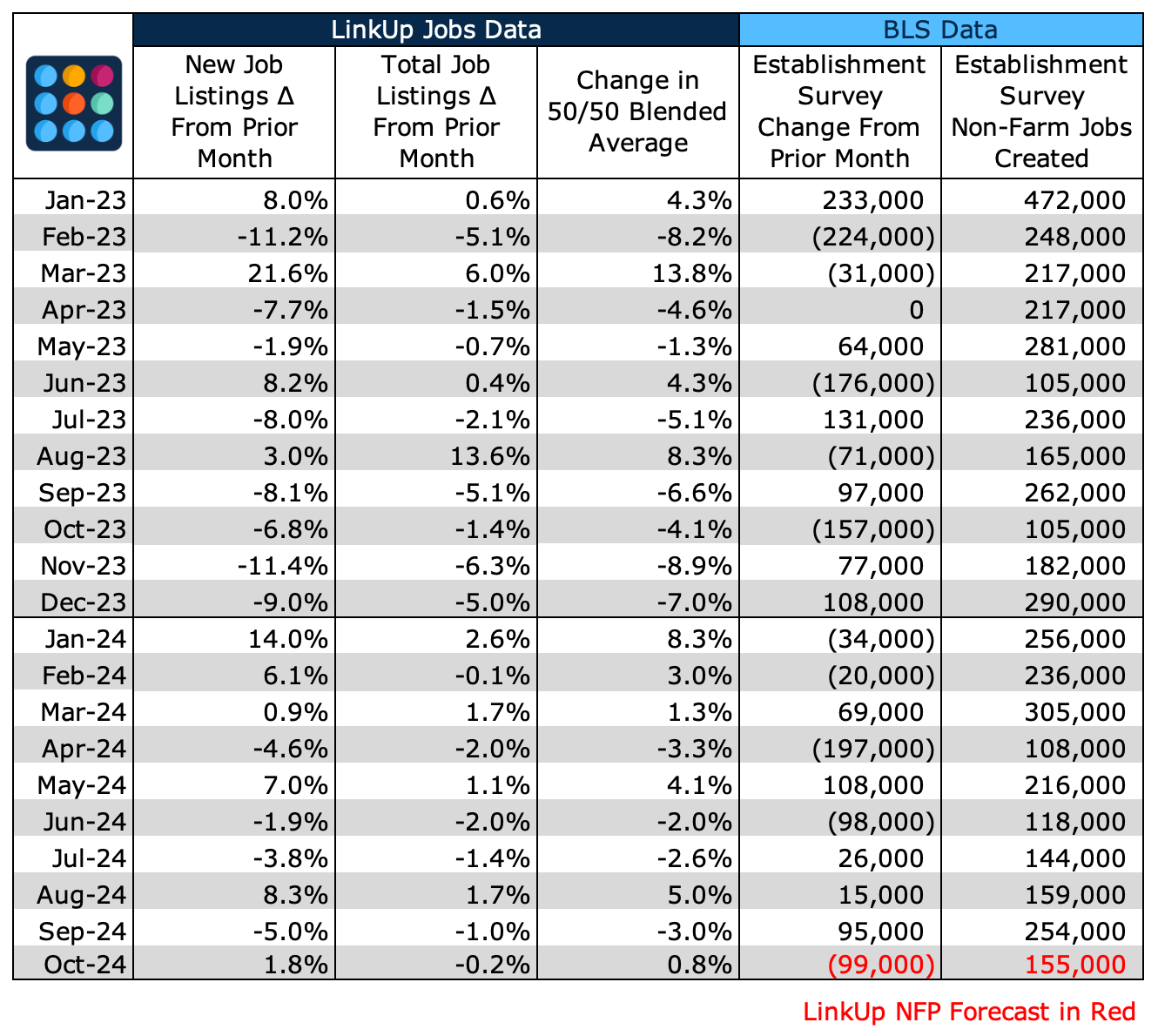

And based on our data, we are forecasting a net gain of 155,000 jobs in October, a decent amount above consensus estimates of 105,000 jobs. Absent the hurricanes, our model actually indicates a net gain of 175,000 jobs, so although we’ve factored in a weather dampening effect of 20,000 jobs, the data continues to validate our larger narrative about the underlying strength of the job market.

In October, total job openings fell 0.2%, while new jobs rose 1.8%.

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., fell 0.4% during the month.

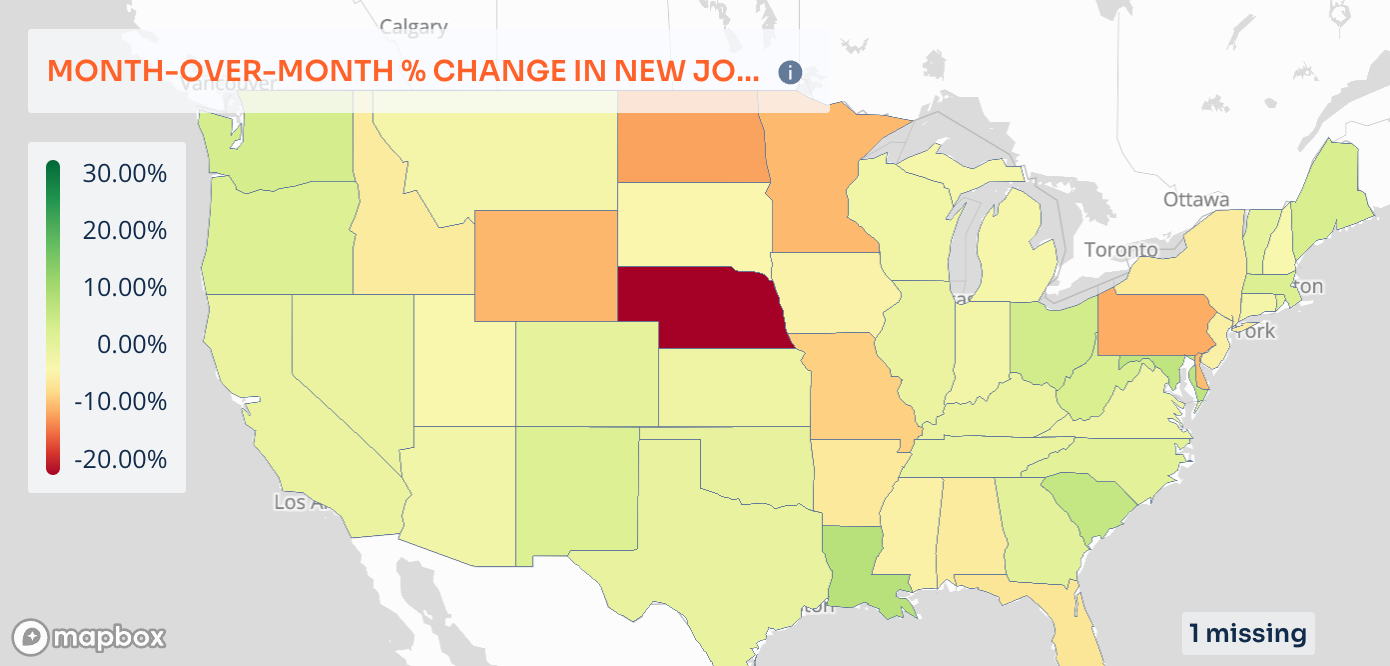

New job openings by state rose in most states with the largest decreases occurring in Nebraska, North Dakota, Pennsylvania and Minnesota.

For the month, labor demand rose slightly in both manufacturing and services.

Industries showing the largest increases in job openings were Transportation, Information, and Healthcare.

Labor demand for white and blue collar jobs rose modestly.

The largest gains by occupation were seen in Personal Care and Services, Healthcare Support, and Architecture/Engineering.

In October, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, rose to 44.5 days - just below the long-term average of 45 days.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration rose in manufacturing and dropped in services.

The rolling 90-day average for Closed Duration fell for both white-collar jobs and blue-collar jobs.

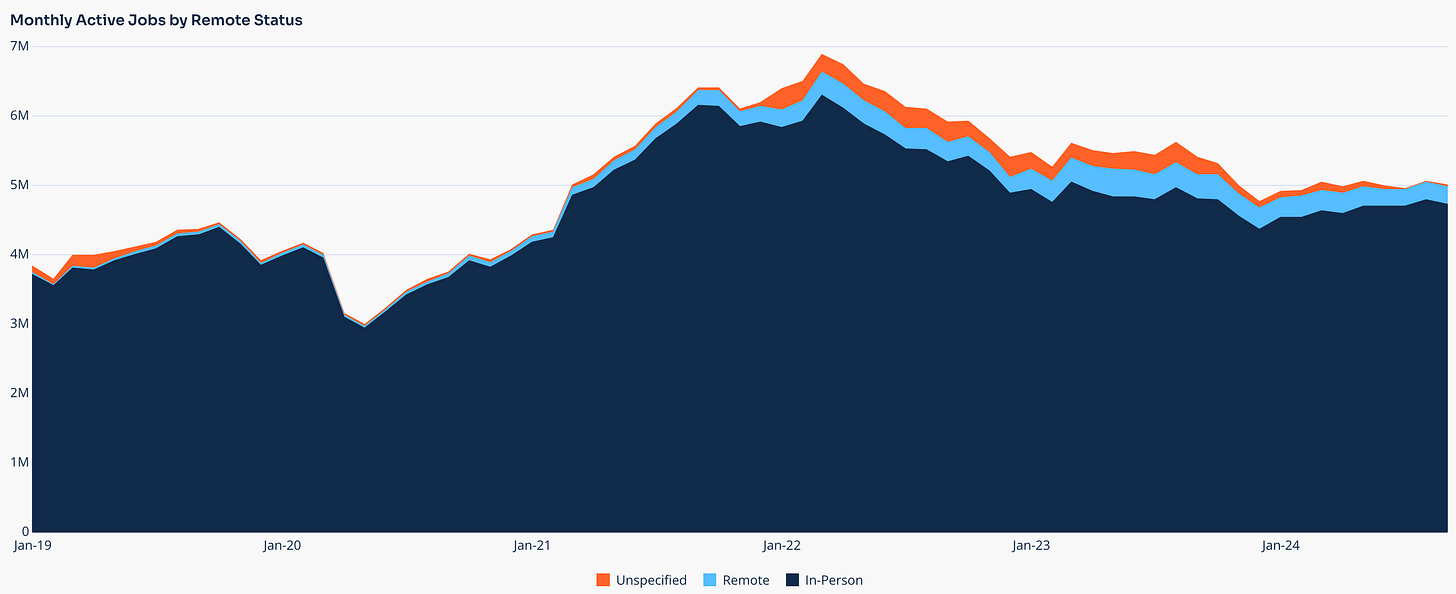

The number of remote job openings in the U.S rose 14bps to 256,743 openings.

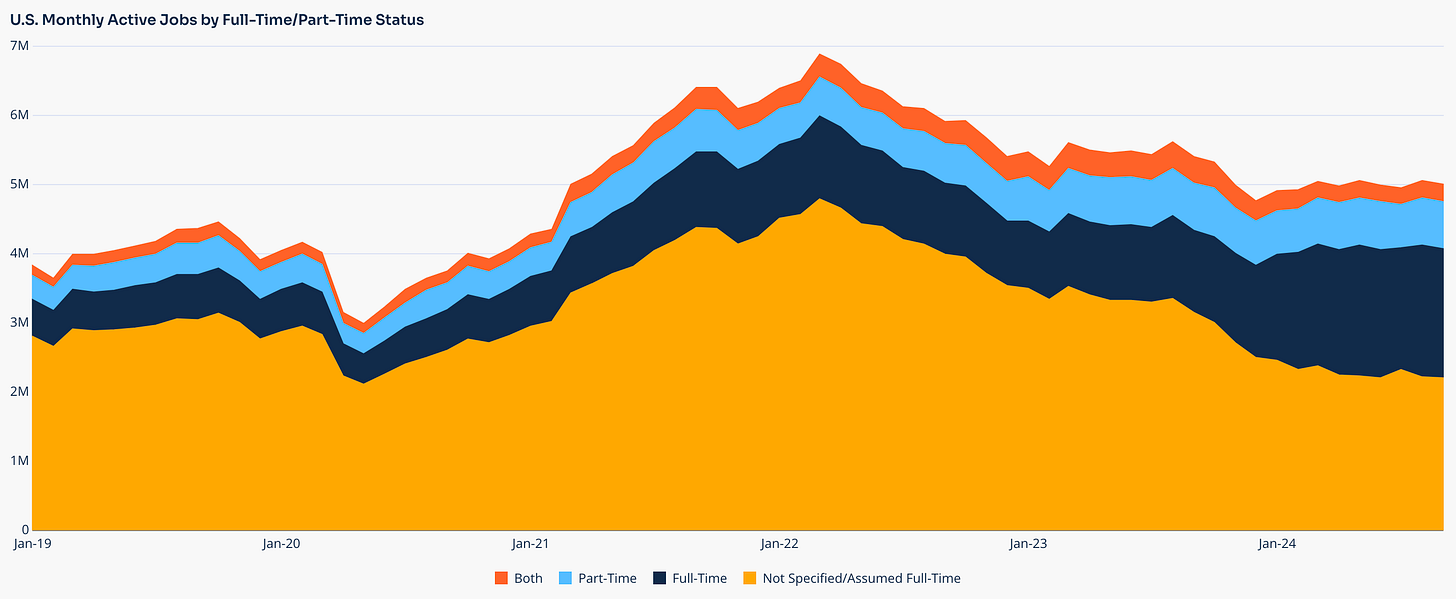

Part-time job openings rose slightly to 681,716 jobs or 14% of all job openings. Openings that allowed for either part-time or full-time rose to 248,650 or 5% of all openings.

In the U.S., 581,187 job openings in October (11.6%) were posted by international companies.

So as noted above, based on our data, we are forecasting a net gain of 155,000 jobs in October, above consensus estimates of 105,000 jobs.

And regardless of October’s jobs report, keep Austan Goolsbee’s message in mind:

“The through-line is the main-line.”