LinkUp Forecasting a Net Gain of 145,000 Jobs in July

Tomorrow's below-consensus payrolls number will round out this week's trifecta of data indicating that it's past time for the Fed to step in.

We published our commentary on the U.S. job market this past weekend (While a recession Is Not in the Cards, the Fed Should Not Wait to Cut Rates) that included our perspective on what we might expect as far as job growth goes for the remainder of the year, so with today’s post, we’ll stick primarily to our July non-farm payrolls (NFP) forecast.

Before we get to our July labor demand data and our NFP forecast, however, a few additional data points were subsequently released this week including a drop in JOLTS data for June and unemployment claims that came in a bit higher than expected. Neither were a cause for concern but they further confirm our view that the downside risk of accelerating weakness in the job market materially outweighs the risk of resurgent inflation and we expect that tomorrow’s below-consensus payrolls number will round out this week’s trifecta of data indicating that it’s past time for the Fed to start cutting rates.

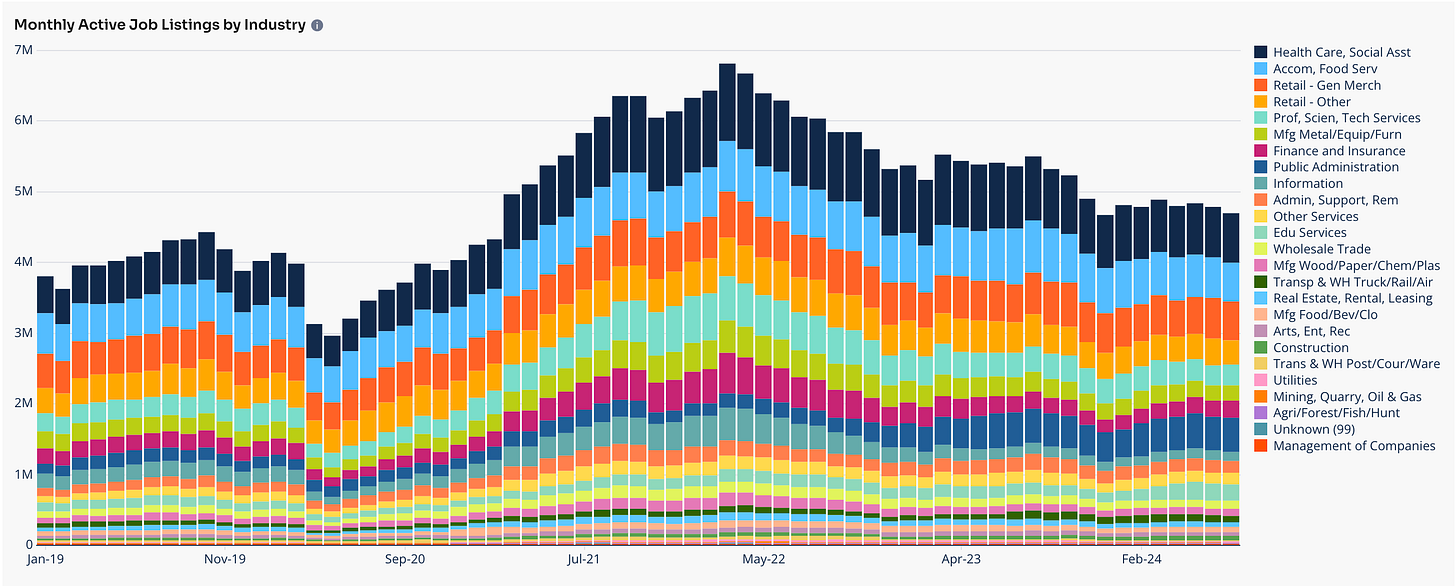

So with that, total U.S. jobs indexed directly from company websites around the world in July fell 1% to 4.86M jobs, with new jobs falling 4% and removed jobs rising 1%.

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., dropped 2% during the month.

New job openings by state rose in only 8 states with the largest increases in New Jersey, Pennsylvania, and California and the largest decreases in Montana, Alabama, and Tennessee.

For the month, labor demand in services dropped a bit more than manufacturing.

Industries showing the largest increases in openings were Local Delivery, Food and Beverage Manufacturing, and Finance/Insurance.

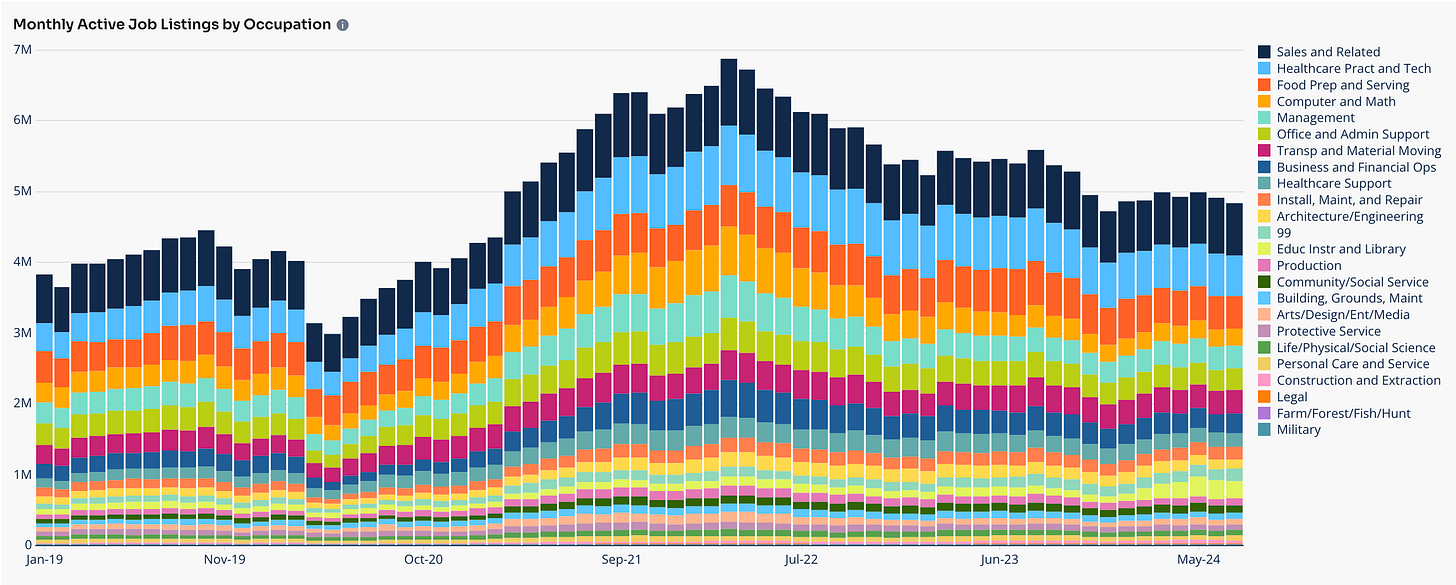

Labor demand for white and blue collar jobs dropped in similar fashion relative to June.

The largest gains by occupation were seen in Personal Care & Services while the largest declines occurred in Sales, Life/Physical/Social Sciences, and Healthcare Practitioners and Technical.

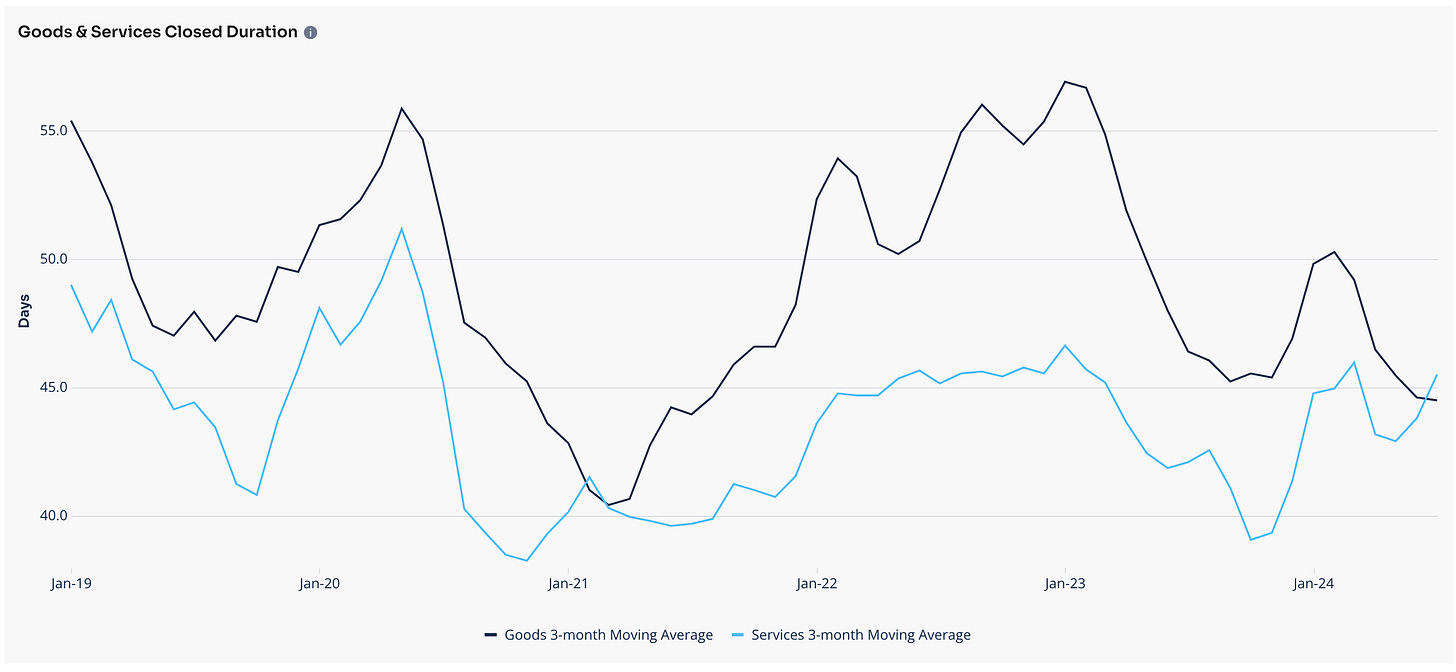

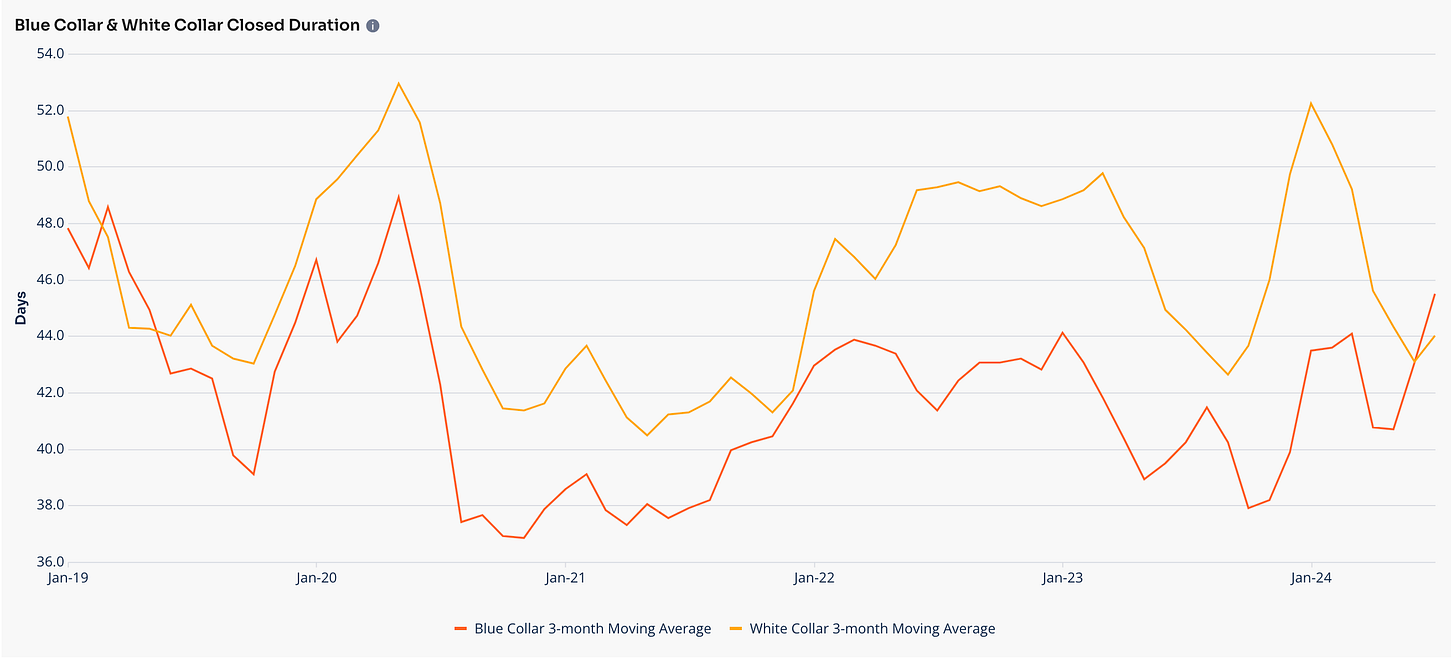

In July, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, dropped to 46 days but the 90-day moving average continued its steady climb as the labor market cools and employers increasingly slow their pace of hiring.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration dropped in manufacturing and rose sharply in services.

The rolling 90-day average for Closed Duration rose for white-collar jobs and continued to climb for blue-collar jobs.

We’ve added two new charts in our Macro Compass data visualization application including remote jobs which dropped 11bp to 4.70%…

…and Jobs by Employer Type which shows, among other things, that public companies accounted for 45% of the labor demand in the U.S. in July.

So as noted above, based on our data, we are forecasting a net gain of 145,000 jobs in July, somewhat below consensus estimates of 175,000 jobs.

Needless to say, the intensity of the spotlight on tomorrow’s jobs report and payrolls and unemployment in particular, couldn’t possibly be higher. Let’s hope things come in as muted and relatively ‘normal’ as what we expect.