With Job Openings Data dropping sharply since October, LinkUp Forecasting Meager Job Gains in December

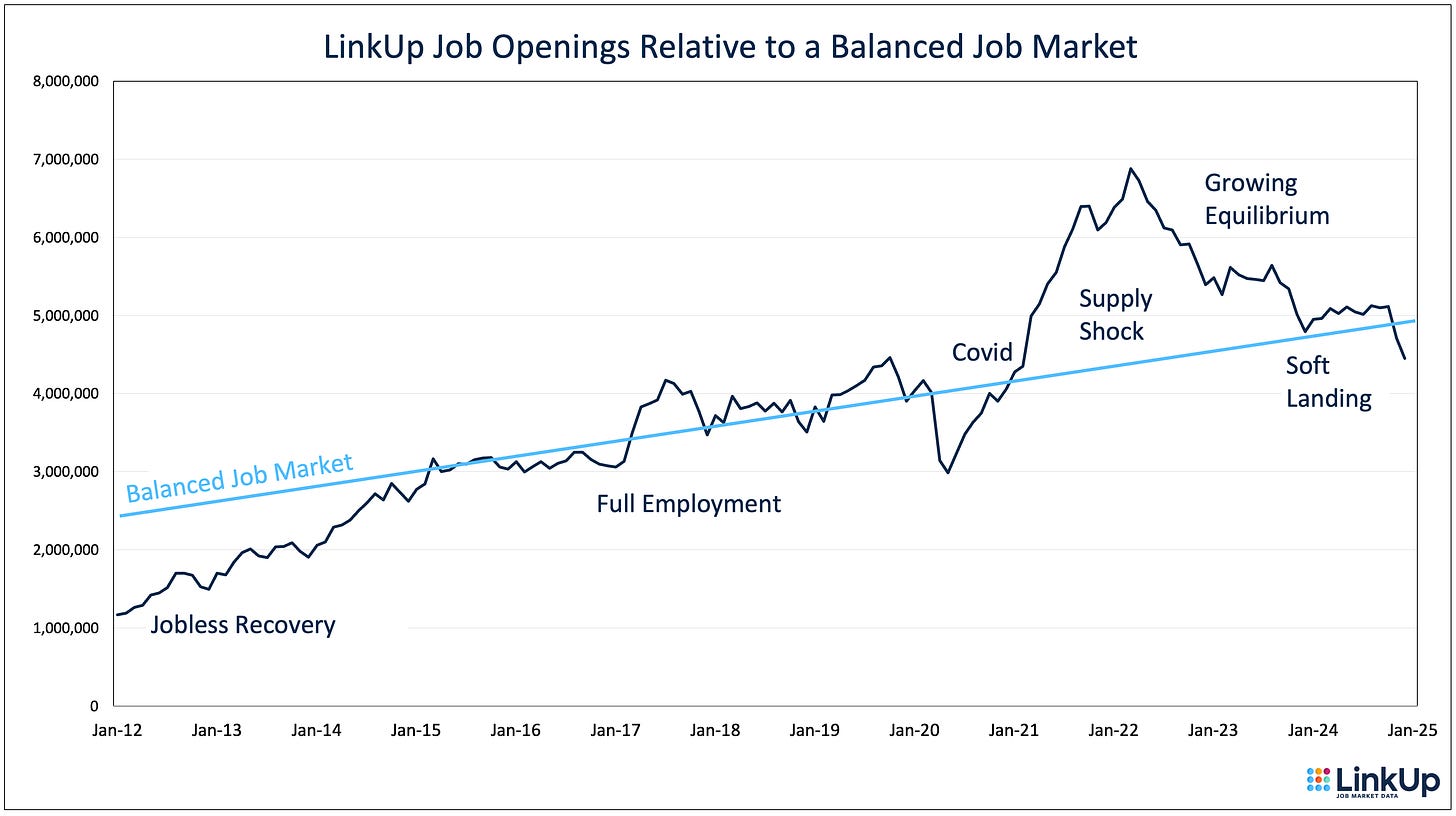

What was, just a few months ago, a perfectly balanced job market appears to be moving materially out of balance

Regardless of the variability among everyone’s estimates around the date of the soft landing (we pegged it in the Fall of ‘23 if not even a bit earlier), the consensus view since pretty much mid-2024 has been that it’s behind us. With inflation near target, labor demand cooling but unemployment remaining benign, and the economy chugging along at a solid but slowing clip, the Fed made its first cut in September, thus closing the book on the Fed’s 2022 tightening regime.

As we said in November 2023 in a post entitled The Soft Landing Happened. Game Over. America Won, “The Fed won. The U.S. economy won. American workers won. American consumers won. Corporate America won. And anyone that had their chip(s) on the soft-landing outcome, we won, too.”

So to be clear, regardless of what happens next, things from here on out have nothing to do with last year, or the year before, or any of the past four years. In November, a new horde of characters, some of whom we’ve seen before, stormed the stage as the curtain was dropping on the just concluded act and precisely at the moment, as indicated by the dark blue line below, that this endlessly fascinating story of the U.S. economy might soon be getting even more interesting.

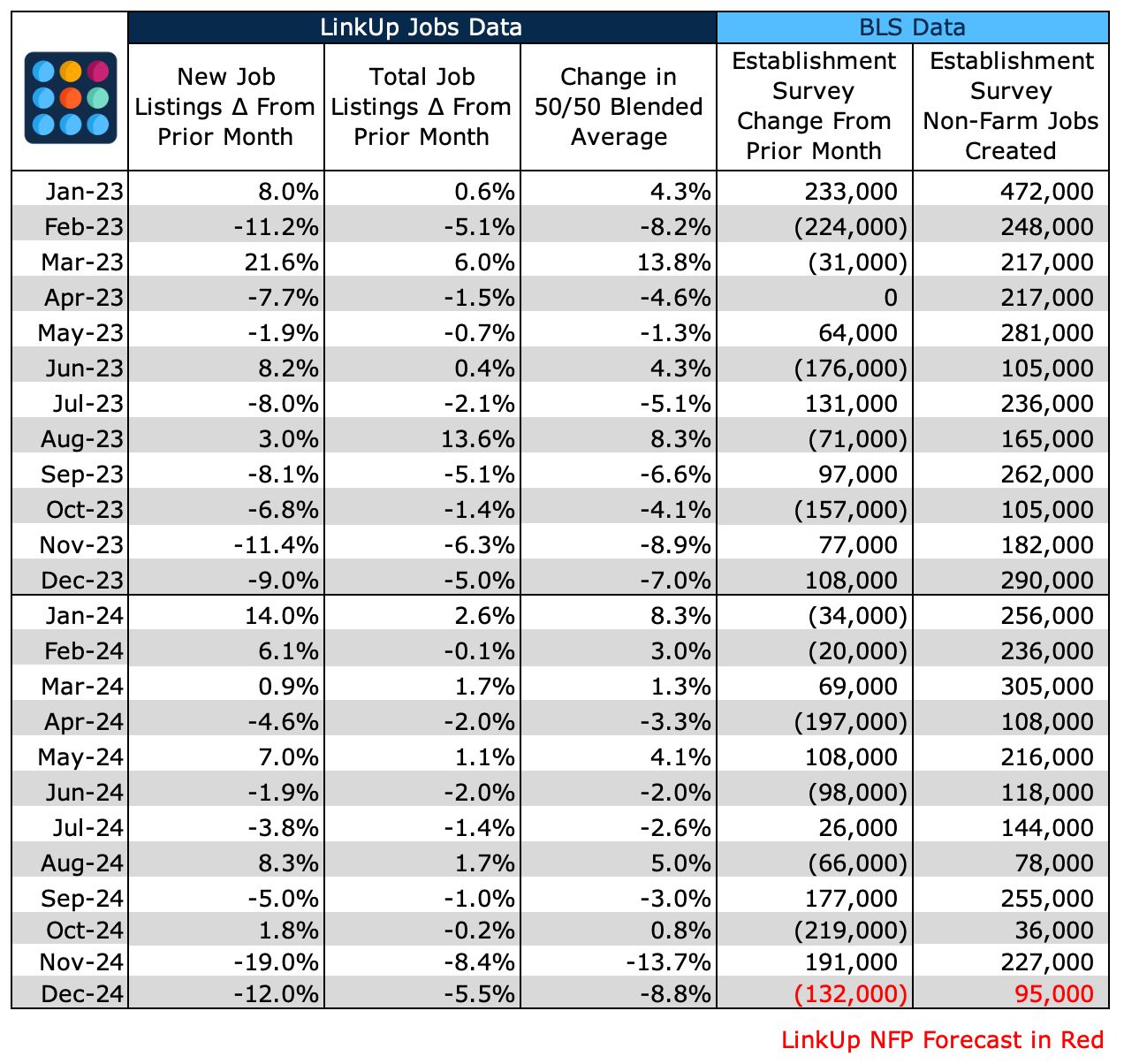

With a 13% drop in total job openings since October and a 30% decline in new job openings, what had been a perfectly balanced job market appears to moving materially out of balance. With just two months of data, particularly given seasonality at the end of the year, it’s a bit premature to get too worked up, but if we’re correct that only 95,000 jobs were added in December, we’d expect to see some volatility in the markets next Friday.

In any event, in December, LinkUp job openings in the U.S., all of them indexed directly from employer websites globally, dropped 6%, while new jobs plummeted by 12% and removed jobs rose 2%.

New job openings dropped in every single state except Maine.

For the month, labor demand dropped sharply again in both manufacturing and services.

Openings dropped in every single industry…

…with the largest declines in Warehouse & Transportation, Wholesale Trade, and Utilities.

Labor demand dropped for both white and blue collar jobs...

…with declines in every single occupation….

…and the largest declines in Arts/Design/Entertainment/Media, Personal Care & Service, and Architecture/Engineering.

In December, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, rose to 50 days - a sharp increase from the prior 4 months.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

So based on our data, we are forecasting a net gain of just 95,000 jobs in December, quite a bit below consensus estimates of 150,000 jobs.

We’ll see what happens next Friday and in the meantime, at some point in the next week or so, we’ll be publishing one or more posts that include a recap of 2024, our self-administered grades around our 2024 predictions, and our predictions for 2025.

For now, though, Happy New Year.