LinkUp Forecasting a Net Gain of Just 130,000 Jobs in November and a Perfectly Normal Ending to 2024 (at Least for the Job Market)

LinkUp Data shows labor demand dropped 8% in November, precisely the average decline seen in all the Novembers since 2013

As the country and the world continue to acclimate to our new collective reality, the mountain of post-election analysis continues to grow and given the volume, quality, and accuracy of most of it, I have little to add.

What I would note, however, is that while the list of myriad factors contributing to Harris’ shellacking seems to be endless, most put inflation at or near the top of the list. And although I’d place gender/misogyny at the top of the list from my perspective (as depressing as that is for the country), inflation was, without question, a dominant factor in the election. As we noted in a headline for a blog post exactly a year ago, “$7 Mayonnaise Might End Democracy.”

But while the majority of the electorate voiced their outrage about inflation and, more broadly, the economy as a whole, neither warrant the ire. Regarding the latter, the post-covid U.S. economy has been phenomenal and continues to be the envy of the world.

In fact, it’s well past time to put the soft landing moniker to bed once and for all, not just because it occurred at least a year ago (closer to two years ago in our estimation) but also because, pertaining to the never-ending saga that is the economy, we have now entered the DJT chapter(s) with a whole new set of characters entering (or re-entering) the storyline.

And regarding covid-era inflation, it’s essentially been vanquished (what happens to inflation in the Trump era will be an entirely different phenomena). And while the remnants of the covid-era inflation, in the form of elevated price levels, deserve some anger, I’d argue that inflation, especially wage inflation, was abnormally low for decades and it took a cataclysmic pandemic to awaken it from its dormancy.

Perhaps more significantly, while people are insanely pissed off about the cost of groceries (just wait until mass deportations and tariffs hit!), I couldn’t agree more with Ezra Klein who makes the case in one of his podcasts (The Economic Theory That Explains Why Americans Are So Mad) that the true source of people’s anger is the unaffordability of big ticket items such as housing, education, healthcare, childcare, and eldercare. It’s the aggravating weekly grocery bill that constantly reminds everyone how outrageously expensive those other things are and until the disfunction in Washington is solved, those larger structural issues will never be fixed.

We’ll have have more to say about the inflation, the covid-era economy, our 2024 predictions, and our outlook for 2025 as we wrap up the year at the end of the month, so for now we’ll turn our attention to our job openings data for November and our non-farm-payroll forecast for the month.

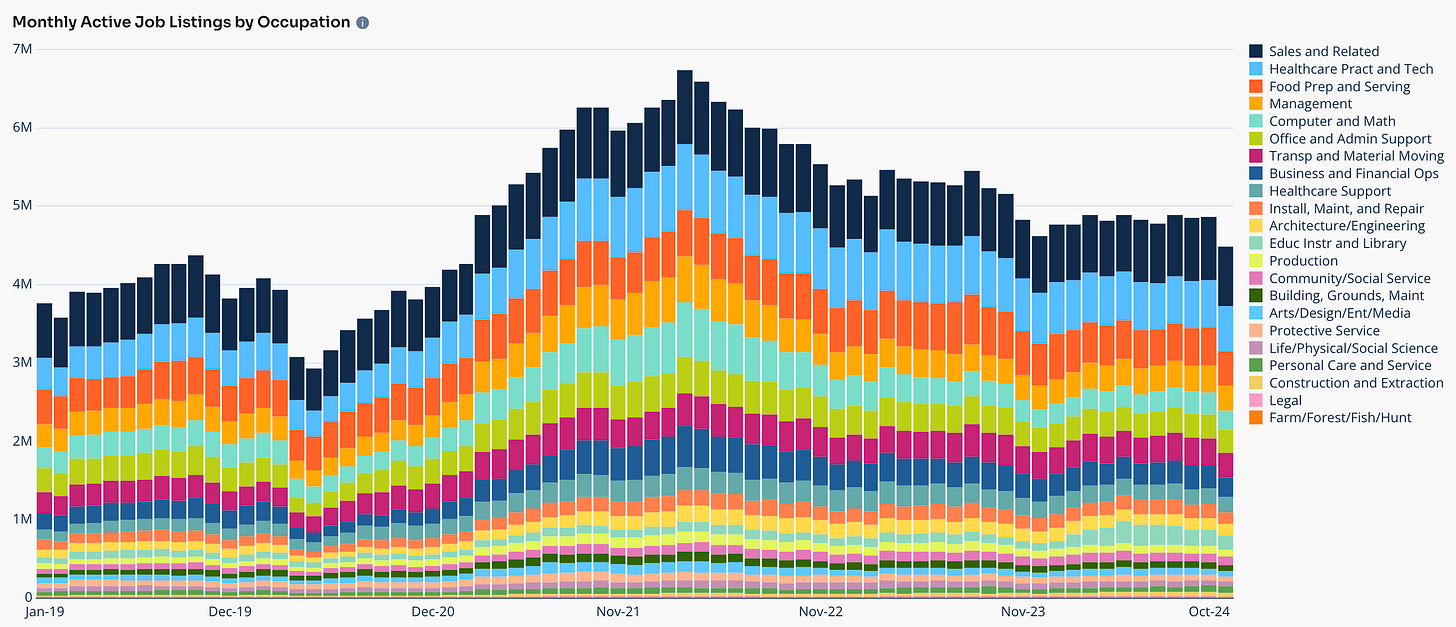

In November, total job openings in the U.S. sourced directly from employer websites globally dropped 8%, while new jobs plummeted by 19% and removed jobs fell 8%.

Looking at the chart below, the drop in labor demand seems alarming but it’s important to note that labor demand has dropped every single November since 2013 by an average of exactly 8%.

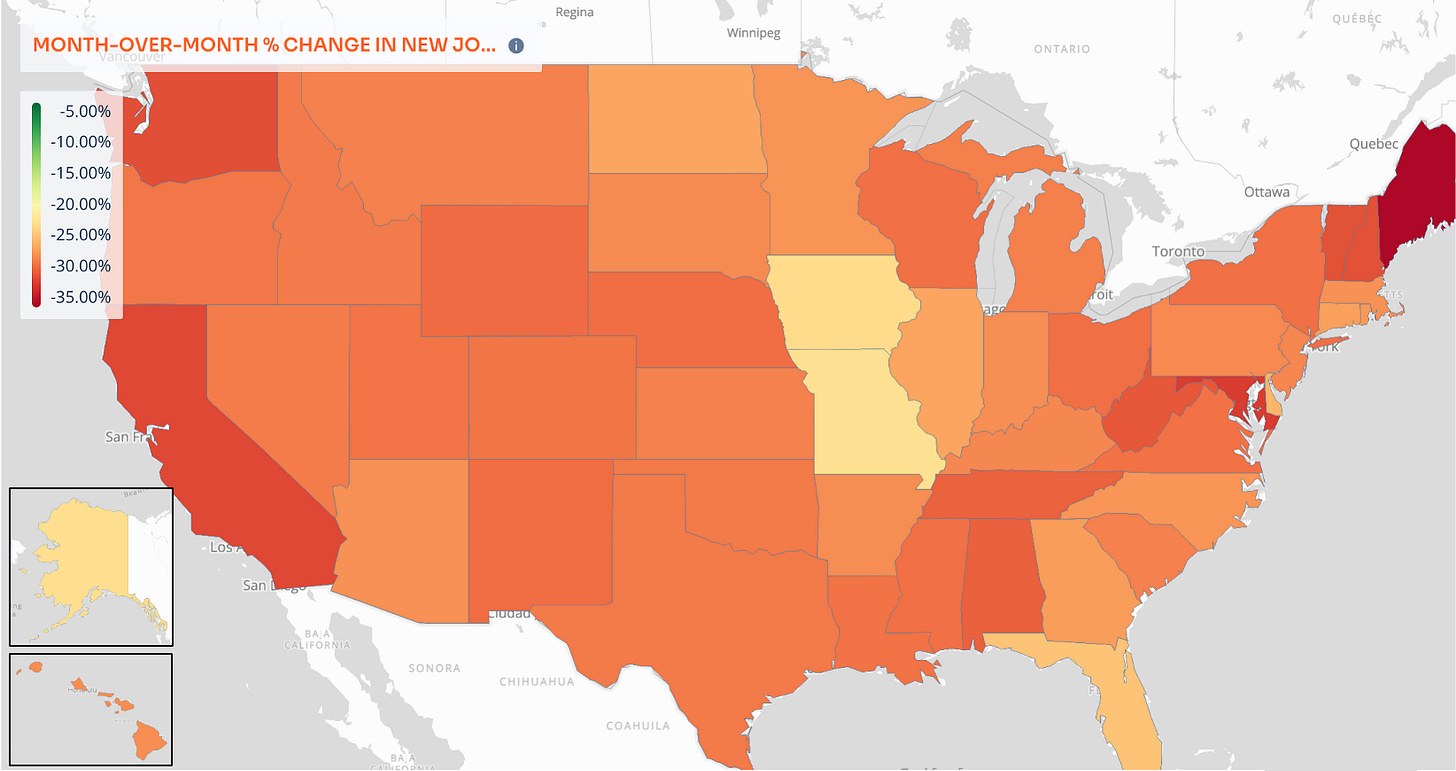

New job openings dropped in every single state with the largest decreases occurring in Maine, Maryland, and California.

For the month, labor demand dropped in both manufacturing and services.

Openings dropped in every single industry…

…with the largest declines in Public Administration, Admin & Support, Warehouse & Transportation, and Utilities.

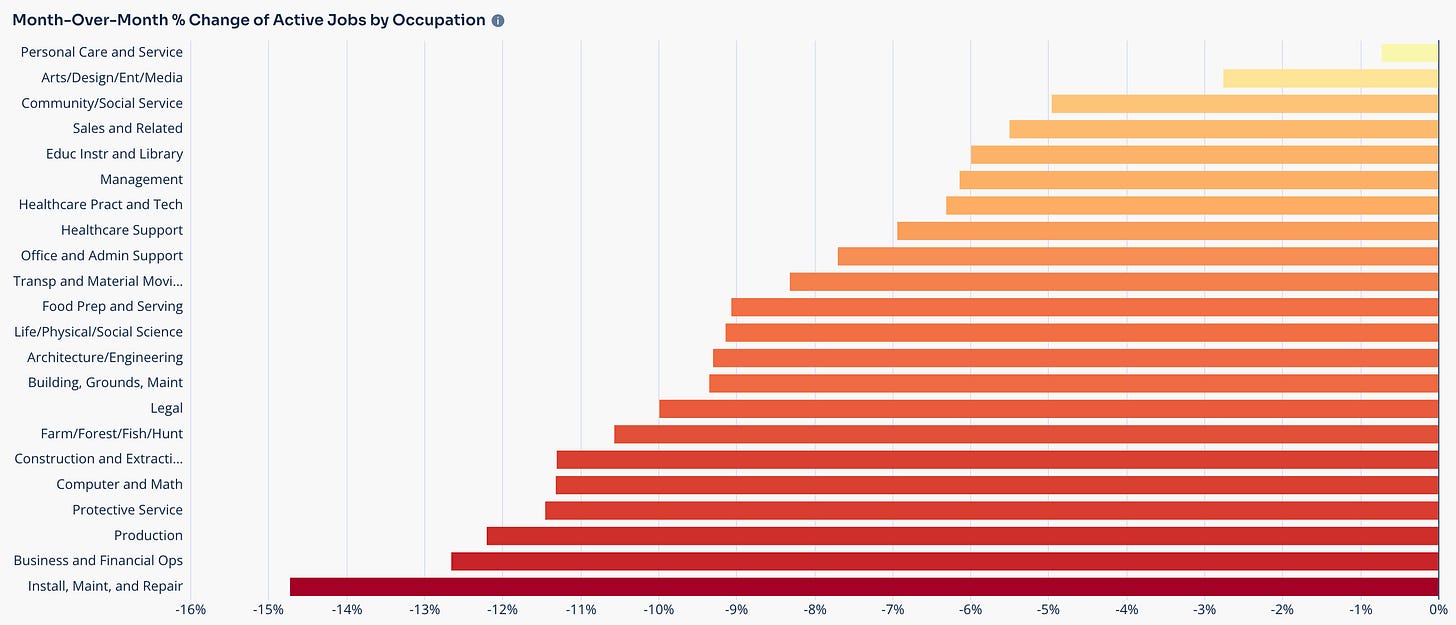

Labor demand dropped for both white and blue collar jobs...

…with declines in every single occupation….

…and the largest declines in Installation/Maintenance/Repair, Business & Financial Operations, Production, and Protective Services.

In November, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, rose to 44 days - just below the long-term average of 45 days.

Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

Part-time job openings declined, but far less than full-time positions.

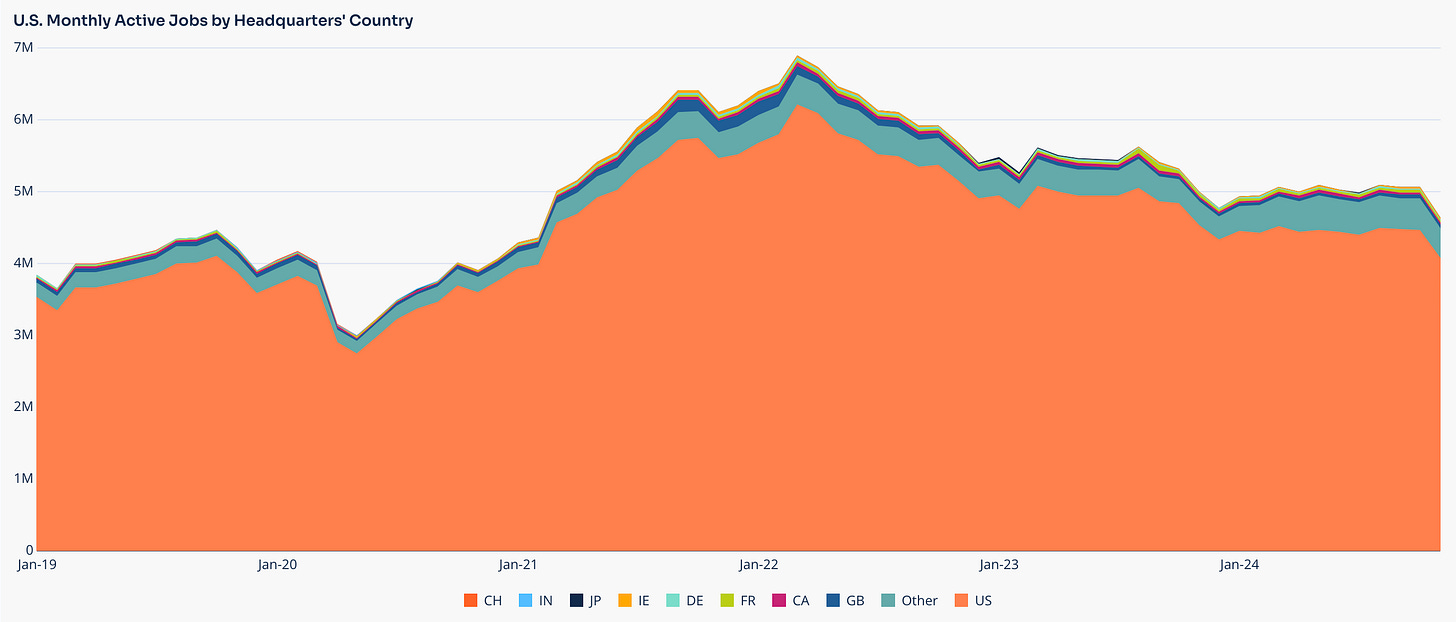

Job openings dropped equally among both domestic and international employers.

So based on our data, we are forecasting a net gain of 130,000 jobs in November, well below consensus estimates of 200,000 jobs.

Going back to the historical data since 2013, with the consistent decline in labor demand every November, average job gains in December for those 11 years, not surprisingly, have dropped by 30% from November (from an average of 295,000 jobs gained in November to just 205,000 in December). So while 2024 has been chaotically abnormal in nearly every respect, it appears as if the year-end job market is behaving in a perfectly normal manner.