Everything About The Job Market & The Economy Is Even-Steven; LinkUp Forecasting 125,000 Jobs In May

A data-dependent Fed is fostering high levels of angst around every data release, but in the aggregate, the macro picture remains one of near-perfect equilibrium and status quo inertia on rates

In one of the great episodes of Seinfeld (The Opposite), Jerry comes to the realization, much to his astonishment, that every time something bad occurs in his life, the situation is quickly rectified with something positive happening to balance it out.

After losing a stand-up gig, he picks up another. He misses the train but then immediately catches a bus. He always breaks even on poker night. After Elaine tosses one of Jerry’s $20 bills out the window as a test, he quickly finds another $20 in his jacket pocket. “It never fails. I always even out,” he declares, after which Kramer assigns him the moniker ‘Even Steven.’

The U.S. economy is operating under precisely the same phenomena. Every time a positive or negative piece of data comes out, another piece of data is released shortly thereafter that counter-balances it.

Of course, in another Seinfeldian twist (The Bizarro Jerry), we’re also living in a bizarro world where good news for the economy is bad news for the markets (and vice versa) because things like strong job gains, elevated wages, and solid consumer spending, for example, mean inflation is likely to remain sticky and rate cuts will continue getting pushed further and further out into the future, much to the chagrin of the markets.

So whether an expansionary or contractionary data point is positive or negative depends on one’s perspective, but seemingly every week for the past month or so, data pointing the economy in one direction or another seems to be quickly offset by a countervailing indicator pointing in the opposite direction.

Some data releases also contain a mixed bag of signals that can be read in multiple ways, supporting whatever view the interpreter brings to bear at the outset. In the case of last week’s Personal Consumption Expenditures (PCE) data, for example, core inflation continued its slow, bumpy drift downward, but debates ensued as to whether or not it’s falling fast enough and/or can sustain its favorable trajectory long enough, without interruption, to give the Fed sufficient confidence to cut rates yet this year.

Fed officials, far from helping clear the fog, have set their dials to maximum obfuscation, often voicing in the same remarks a range of possible scenarios spanning the spectrum from one or more rate cuts this year to none to the next move possibly being a rate increase.

Needless to say, market angst remains high as the fog around the economy’s direction fails to dissipate. We’d note, however, that it’s precisely that condition which presently defines the current state of the economy. Everything is positive but muted - growth, jobs, wages, business, consumers, spending, inflation, sentiment, etc. - all of which points to massive inertia in favor of the status quo.

Even Steven - everything in balance, drifting along in a quite pleasant, steady state.

The U.S. job market, the massive keel serving as ballast keeping us on our present course (and continuing to drive Fed policy and, therefore, global markets), remains in near-perfect equilibrium in a full employment environment - a place we forecasted back in January (10 predictions for the coming year) that we’d remain for all of 2024.

In that same list of predictions, we also forecasted that job gains for the year would average 130,000 per month, nearly identical to the number we’re forecasting for May based on our April data.

But while that below-consensus number may disappoint some while delighting others, our job openings data for May, in perfect Even-Steven fashion, points to stronger job gains in June, so things should balance out.

In May, total U.S. jobs indexed directly from company websites around the world rose 1% to 4.98M jobs, while new jobs jumped 7% and removed jobs spiked by 22%.

Similarly, the LinkUp 10,000 - a metric that tracks total U.S. job openings from the 10,000 global employers with the most openings in the U.S., rose 0.5%.

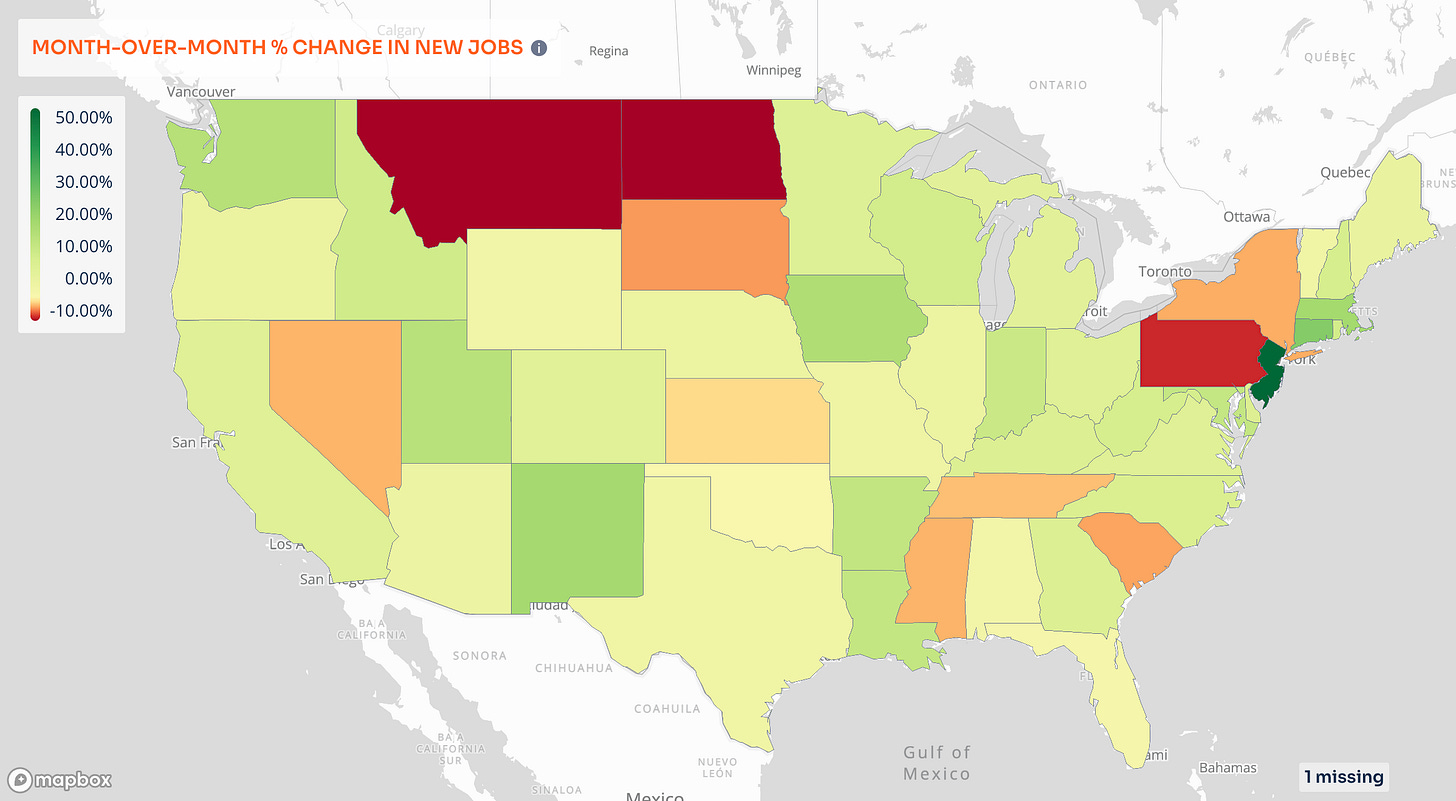

New job openings by state rose across much of the country with the largest increases in New Jersey, Connecticut, and Massachusetts.

For the month (and since the beginning of the year), labor demand in manufacturing and services has remained essentially flat.

Industries showing the largest increases in openings were Finance (6%), Construction (4%), and Public Administration (4%).

Labor demand for white collar jobs continued its steady climb since the beginning of the years while demand for blue collar jobs remained essentially flat.

The largest gains by occupation were seen in Arts/Design/Media/Entertainment (21%), Protective Services (4%), and Construction (4%).

In May, Closed Duration, which essentially measures Time-to-Fill or Hiring Velocity across the entire economy, jumped to 46 days after dropping in April. Closed Duration is a highly useful metric that measures Time-to-Fill based on the number of days an opening, on average, is open on a company’s corporate career portal before it is closed and removed.

The rolling 90-day average for Closed Duration dropped in manufacturing and rose in services.

Similarly, the rolling 90-day average for Closed Duration dropped for white-collar jobs and rose for blue-collar jobs.

So as noted above, based on our data from April, we are forecasting a net gain of 125,000 jobs in May, a notch or two below consensus estimates of 180,000 jobs.

But as we also noted earlier, rest assured that things should balance out soon enough with stronger job gains in June. Even Steven.